Builders Show Growing Confidence as Lower Mortgage Rates Drive Optimism

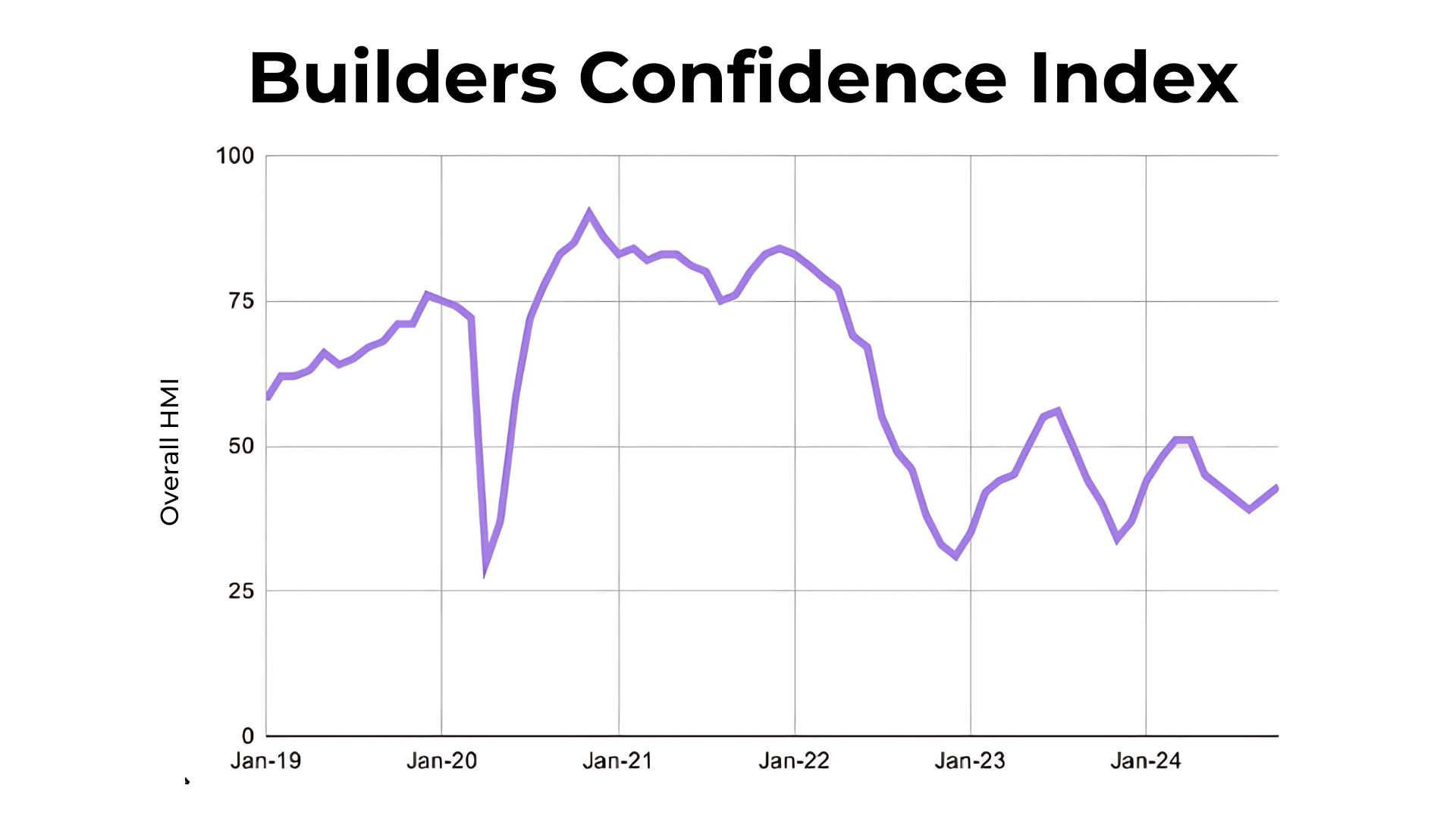

The National Association of Homebuilders (NAHB) Confidence Index saw an encouraging rise of 2 points in September, bringing it to 43.

Now, while this number is still below the bullish threshold of 50 (which signals an expansionary environment for new home sales), it’s the second month in a row of improvement.

The momentum we’re seeing is largely due to lower mortgage rates over the past four months, which has given builders renewed confidence in the market.

Breaking Down Builder Sentiment

The NAHB index is composed of three key elements: Current Sales Expectations, Future Sales Expectations, and Buyer Traffic. In September, all three of these components rose month-over-month. What’s particularly notable is that the Future Sales Expectations component now sits at 57—a bullish signal indicating optimism about the road ahead. The 10-point gap between future and current sales expectations is the largest it’s been in five years, which points to growing builder confidence that lower rates will drive new home sales in the coming months.

Homebuyers Waiting for Election Results

Even with builder optimism rising, some prospective buyers are still in wait-and-see mode. According to a recent Redfin survey, 23% of first-time buyers said they plan to hold off on purchasing until after the U.S. presidential election. They’re waiting to see what the political landscape will look like and how potential housing policies might affect them.

Interestingly, nearly one-third of respondents said that housing affordability is a top-three issue when deciding who to vote for. This underscores just how important housing policy will be in the upcoming election. But as far as solutions go, here’s my take: Rent controls and big first-time buyer grants aren’t the answer. The key to addressing the housing shortage is building more homes. Additionally, keeping large investors out of the single-family housing market would help preserve affordability for individual buyers.

Rents Continue to Decline

Another trend that’s catching my eye is the continued cooling in the rental market. In September, nationwide asking rents were down 0.5% year-over-year, marking the 14th consecutive month of slight annual declines. Cities like Nashville (-4.8%), Dallas-Fort Worth (-4.0%), Denver (-4.0%), and Austin (-3.7%) saw some of the biggest rent drops, while cities like Cincinnati (+3.4%), DC Metro (+2.9%), and NYC Metro (+2.8%) experienced modest rent increases.

Zillow Forecasts Modest Home Price Growth Ahead

Looking ahead, Zillow is predicting modest home price growth on a national level. Their latest forecast calls for home prices to rise 2% in 2024, but just 0.9% over the next 12 months through September 2025. The reason? Rising inventory levels are expected to keep price growth in check.

Of course, a national average like this means we can expect price declines in certain cities. Zillow’s map reveals where they anticipate potential price softening, so keep an eye on those local markets if you’re thinking about buying or selling.

Conclusion

As we head into the final months of 2024, there’s a lot to watch in the housing market. Builder confidence is growing, and while mortgage rates have come down slightly, buyers are still cautious—many waiting to see how economic and political factors shake out. Meanwhile, rents are cooling, and home price growth is expected to remain modest in the coming year.

For buyers, sellers, and investors alike, it’s a market in flux. Staying informed on these trends and working with a real estate professional who understands both the national and local dynamics can help you make the right decisions moving forward.

Categories

Recent Posts

GET MORE INFORMATION