December CPI Eases Inflation, Boosting Hopes for Boston’s Spring Housing Market

With inflation cooling and home inventory rising, Boston homebuyers and sellers could see new opportunities this spring. Here’s what to expect in the months ahead.

Encouraging Signs for Boston’s Housing Market

The December Consumer Price Index (CPI) report brought a much-needed dose of optimism to Boston’s real estate market. Inflation is slowing, mortgage rates are edging lower, and the inventory of available homes continues to grow. These trends could combine to create a more favorable landscape for buyers and sellers alike as we gear up for the 2025 spring selling season.

Inflation Slows: A Welcome Break for Boston Buyers

For Boston-area buyers, the latest inflation numbers signal some relief:

- Wholesale Inflation (PPI): December’s Producer Price Index rose a modest 0.2% month-over-month, with “core” PPI remaining flat. This suggests businesses are seeing less pressure on costs.

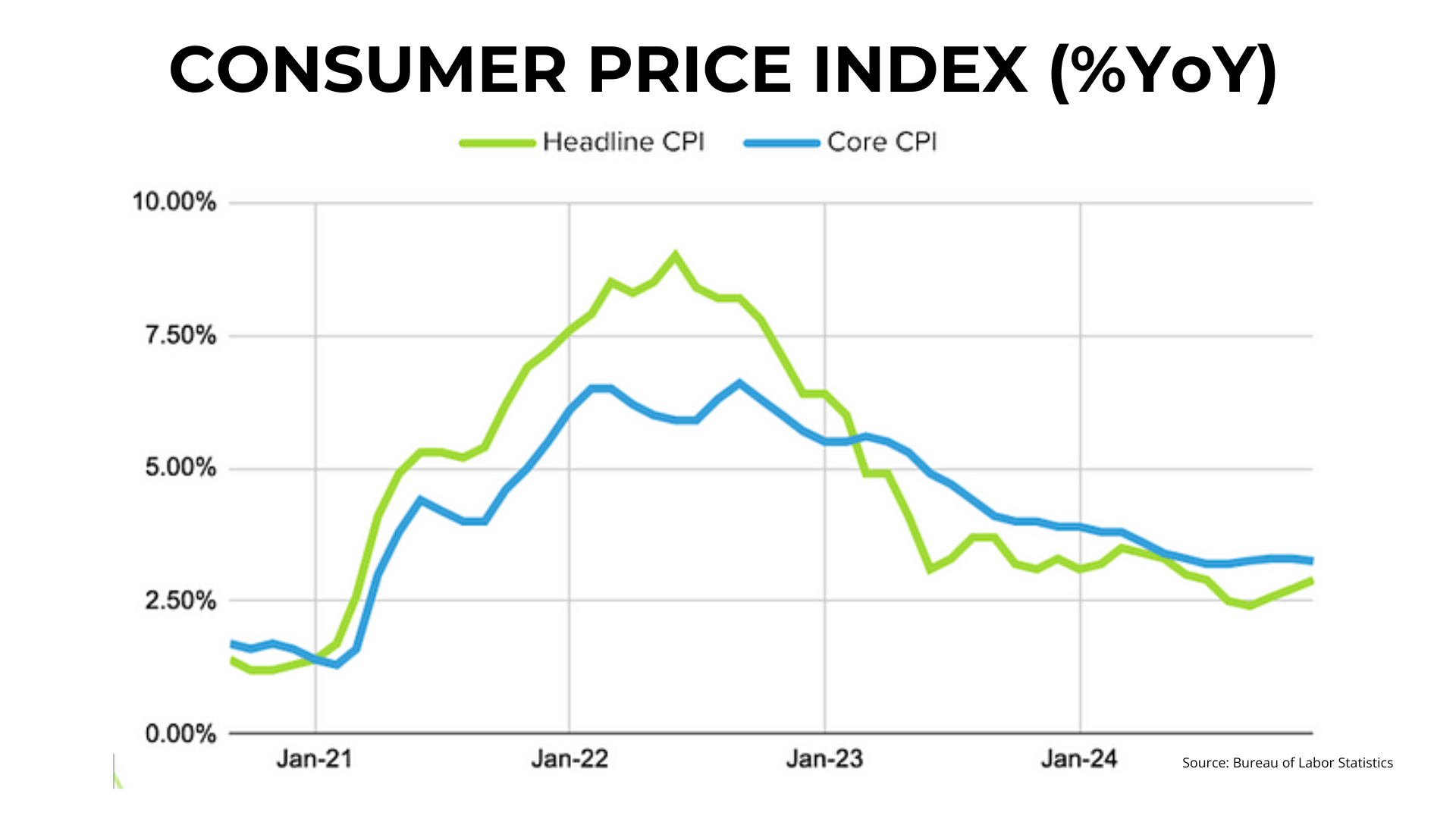

- Consumer Inflation (CPI): December’s core CPI rose only 0.2% month-over-month, while the year-over-year inflation rate dipped from 3.30% in November to 3.25% in December. These shifts have helped stabilize bond markets, lowering average 30-year mortgage rates to around 7.1%.

For prospective buyers, lower inflation and mortgage rates mean an opportunity to lock in more favorable financing terms, which could help offset rising home prices in Boston's competitive market.

Inventory is on the Rise: More Options for Boston Buyers

The inventory of homes for sale is steadily climbing, offering Boston buyers more opportunities as the spring market approaches. While housing supply remains tight in many Massachusetts neighborhoods, the trend toward higher inventory is a promising sign.

Builders are also showing cautious optimism. According to the National Association of Homebuilders (NAHB), builder sentiment improved slightly in December, with present market conditions moving into bullish territory. However, future expectations fell, reflecting ongoing concerns about mortgage rates.

HOA Fees on the Rise: What Boston Buyers Should Know

Another factor for Boston buyers to consider is the increasing prevalence of HOA fees. In 2024, 40.5% of properties included HOA fees, up from 39.2% the year before. The median monthly HOA fee now stands at $125, a 14% increase from 2023.

While Boston’s urban areas have fewer HOA-governed properties compared to cities like Houston or Las Vegas, buyers should still account for these costs when calculating their total housing expenses.

What to Expect in Spring 2025

Boston’s spring housing market is shaping up to be more active than in previous years.

With inflation easing, mortgage rates softening, and inventory improving, buyers may finally have a chance to gain some traction in what has been a challenging market.

Whether you’re buying or selling, staying informed and acting decisively will be critical this spring. At Digital Realty US, I specialize in helping clients navigate Boston’s dynamic real estate market with confidence. Let’s make your 2025 real estate goals a reality.

Categories

Recent Posts

GET MORE INFORMATION