Deciphering Boston's Housing Market: The High Stakes of Down Payments

In the world of real estate, numbers and figures often hold the key to understanding the ever-evolving dynamics of housing markets. A recent report from LendingTree, the financial services company, sheds light on the fascinating realm of down payments in the 50 largest metropolitan areas across the United States. Unsurprisingly, the statistics reveal that the city of Boston, renowned for its higher-than-average home prices, is home to some of the loftiest down payment requirements.

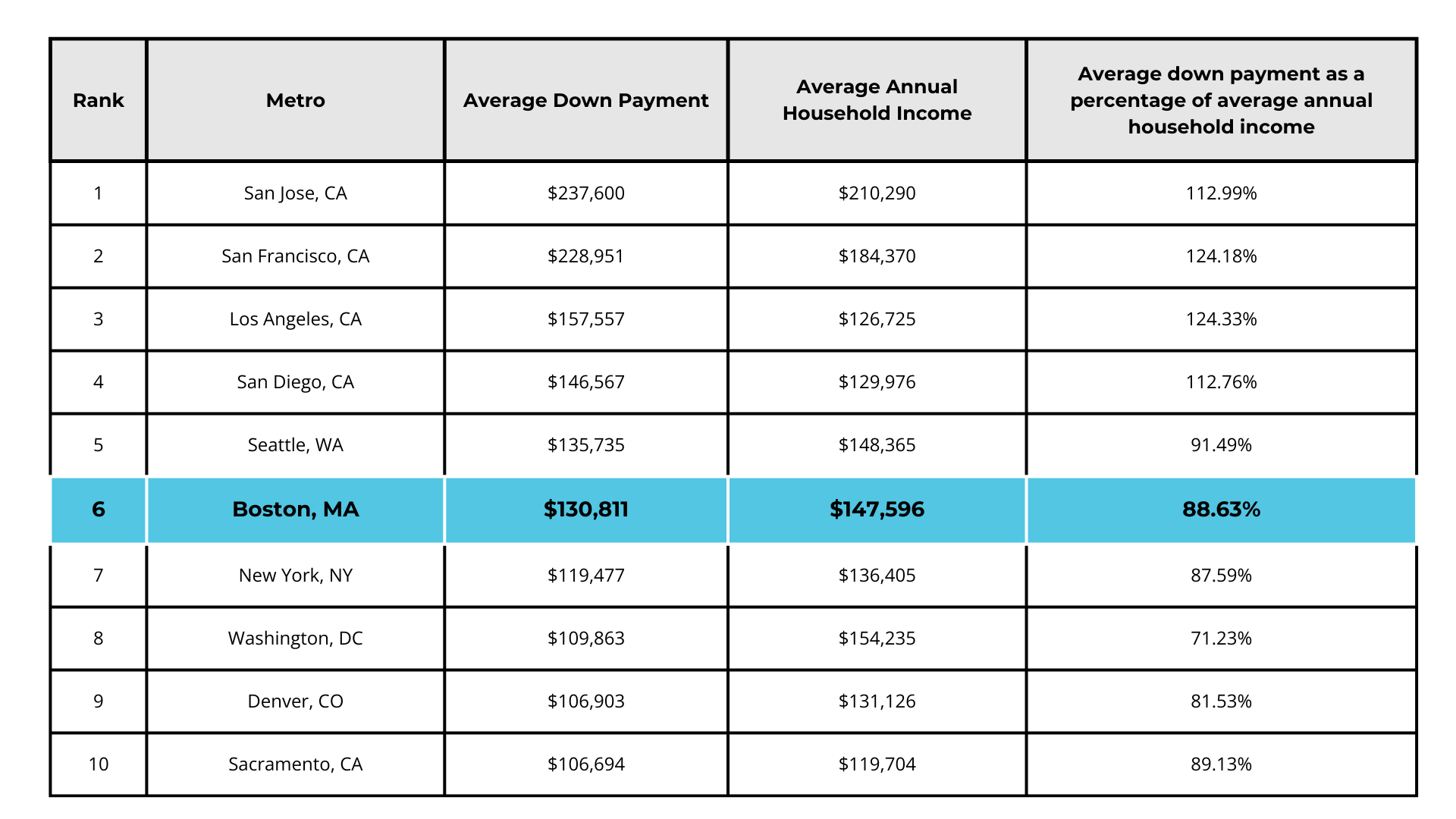

According to LendingTree's findings, the average down payment in the vibrant metro Boston area stands at an eye-popping $130,811. This places Boston sixth on the list of cities with the highest average down payments in the nation. But what's the story behind these substantial down payments, and how do individuals who rely on profits from a previous home sale factor into this equation?

Source: LendingTree analysis of internal and U.S. Census Bureau data.

Source: LendingTree analysis of internal and U.S. Census Bureau data.

LendingTree's report acknowledges that there might be exceptions, where individuals use proceeds from a prior home sale to fund their new down payment. However, the overall data suggests that saving for a down payment is, without a doubt, a time-consuming endeavor in most areas.

To uncover the intricacies of high down payments, LendingTree meticulously examined data from over 580,000 users within the 50 largest metropolitan areas who secured 30-year fixed-rate mortgages with down payments greater than zero between January 1 and September 30, 2023. The report highlighted that the average down payment in these metropolitan areas typically exceeded $47,900, with certain exceptionally costly regions demanding down payments of more than $200,000. In this year's study, no metropolitan area reported an average down payment of less than $47,900.

As if the substantial down payments weren't challenging enough, Boston residents have also faced the burden of increasing mortgage rates. As of a recent report from NerdWallet, 30-year fixed loan rates in Boston climbed to a staggering 7.925%. But before prospective homebuyers in the Boston area throw in the towel, it's important to remember that there's still hope on the horizon.

Federal, state, and city programs are available to support first-time buyers in their quest for homeownership. While down payments remain a vital component of the home-buying process, it's essential to recognize that they aren't the sole determining factor. Jacob Channel, senior economist at LendingTree and the author of the report, points out, "Though they are important, buyers should remember that a down payment isn't everything. Even if you don't have tens of thousands of dollars at your disposal for a down payment, it doesn't mean that homeownership is out of reach. Many lenders offer specific loan options, such as FHA mortgages, which don't necessarily require exorbitant down payments."

In the competitive and ever-evolving world of real estate, knowledge is power. Understanding the nuances of down payments, mortgage rates, and available programs can make all the difference when it comes to achieving the dream of owning a home in the vibrant city of Boston. So, while the path to homeownership may be challenging, it is by no means insurmountable. With the right information and guidance, your real estate goals are within reach.

Categories

Recent Posts

GET MORE INFORMATION