Mortgage Market Update: Navigating Volatility in Rates and Economic Indicators

Whipsawing Mortgage Rates

Over the past few weeks, mortgage rates have been on a rollercoaster ride, influenced by fluctuating economic indicators and central bank actions. Here's a breakdown of the key factors driving this volatility:

Jobs Data Impact

- Positive JOLTS and ADP Reports: Early reports from the Job Openings and Labor Turnover Survey (JOLTS) and ADP Employment Report showed stronger-than-expected job openings and private sector employment gains, initially pushing mortgage rates higher.

- Mixed Signals from BLS: Contrarily, the Bureau of Labor Statistics (BLS) provided mixed signals with its jobs report, which showed higher-than-expected job additions but also a slight uptick in the unemployment rate. This uncertainty caused mortgage rates to dip temporarily.

Inflation and Federal Reserve Actions

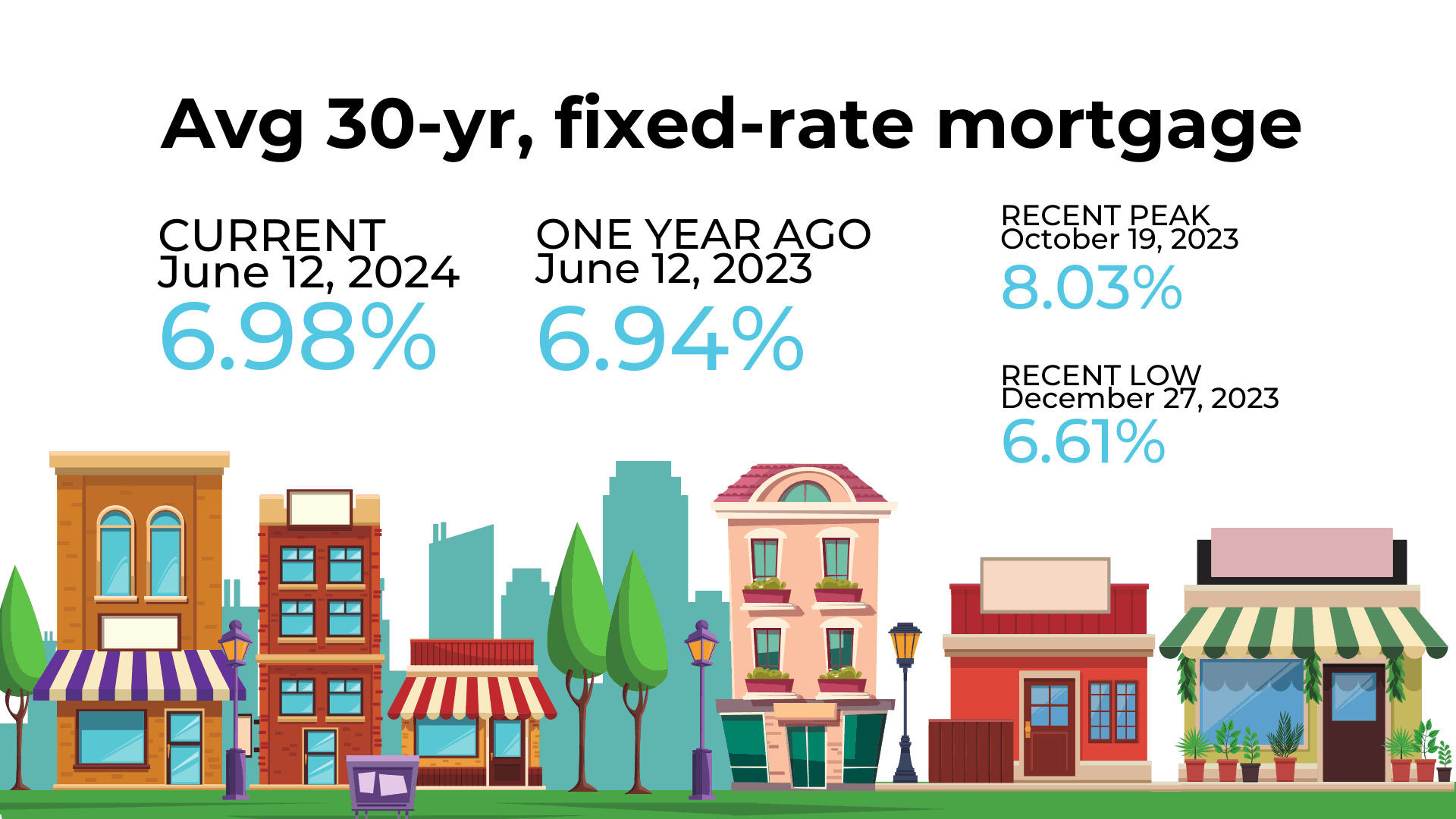

- Lower-than-Expected CPI: Last Wednesday, the Consumer Price Index (CPI) data came in lower than expected, signaling a slowdown in inflation. This positive news, coupled with Federal Reserve Chair Jerome Powell's dovish remarks, helped bring average 30-year mortgage rates back down near 7.0%.

- Central Bank Rate Cuts: Both the European Central Bank (ECB) and the Bank of Canada cut their interest rates, reflecting their respective efforts to stimulate economic growth and control inflation. However, progress on US inflation has slowed since early 2023, with the core Personal Consumption Expenditures (PCE) price index at 2.8% in April 2024, still above the Fed’s 2% target.

Fed Rate Cut Odds

The Federal Open Market Committee (FOMC) has been closely watched, especially with the upcoming US Presidential election on November 5. The current odds for rate cuts at upcoming FOMC meetings are as follows:

- July 31: 9% (steady from 9% on June 10)

- September 18: 63% (up from 47% on June 10)

- November 7: 77% (up from 62% on June 10)

These odds reflect increasing market anticipation for rate cuts later in the year as economic conditions and inflation dynamics evolve.

What This Means for Homebuyers and Real Estate Professionals

The volatility in mortgage rates poses both challenges and opportunities for homebuyers and real estate professionals:

For Homebuyers

- Lock in Rates: Given the fluctuations, homebuyers should consider locking in mortgage rates when they dip. Consulting with a mortgage advisor can help determine the best timing.

- Assumable Mortgages: With rates fluctuating, exploring assumable mortgages, particularly those backed by government loans like FHA and VA, can offer potential savings. However, these come with conditions and complexities that need careful consideration.

For Real Estate Professionals

- Stay Informed: Keeping abreast of economic indicators and central bank actions is crucial for advising clients effectively. Understanding the implications of rate changes can help guide buyers and sellers in making informed decisions.

- Market Dynamics: Regional variations in home price growth highlight the importance of local market knowledge. While national trends provide a broad picture, local conditions will often dictate specific strategies for pricing, marketing, and negotiations.

Conclusion

Navigating the current mortgage market requires staying informed about economic trends, central bank actions, and their impacts on mortgage rates. Both homebuyers and real estate professionals need to be agile and well-informed to make the most of the opportunities and mitigate the challenges posed by this volatile environment.

Categories

Recent Posts

GET MORE INFORMATION