Mortgage Rates Drop to Low Sixes: What This Means for the National Housing Market

As we transition into the fall of 2024, one of the most significant developments in real estate is the decline in 30-year mortgage rates, which have now dropped into the low sixes. This downward shift reflects the market’s anticipation of upcoming Federal Reserve rate cuts, possibly in response to an expected economic slowdown or even a recession.

While real estate activity typically cools off as summer ends, now is a prime time to take advantage of shifting conditions by reconnecting with your contacts.

Weak Jobs Data and Its Impact on the Housing Market

The August 2024 jobs report from the Bureau of Labor Statistics (BLS) confirmed a slowdown in employment growth. Only 142,000 jobs were added in August, which was below the expected 165,000. On top of that, July’s employment numbers were revised downward by 86,000, with the initial 114,000 jobs growth now being adjusted to 89,000. The unemployment rate is also inching up, indicating the potential for further economic cooling.

For the real estate market, these job numbers could signal softer demand in the near term. However, as interest rates continue to fall, we may see an uptick in buyer activity, particularly if the Federal Reserve continues to cut rates to stimulate the economy.

Sluggish Housing Demand, Despite Lower Rates

The MBS Highway National Housing Index fell by 2 points in September, marking the fifth straight month of decline, with the index now at 40. Despite the notable drop in mortgage rates over the past four months, the housing market hasn’t fully rebounded yet, largely due to seasonal factors. However, some regions are performing better than others, with the Northeast and Mid-Atlantic seeing more activity compared to the Southeast and Southwest.

Refinance Activity Surges as Rates Fall

While home buying demand remains muted, refinance applications are soaring. The Mortgage Bankers Association (MBA) reported that refinance volumes are up 106% year-over-year, with refinances now accounting for 47% of all mortgage applications. Homeowners with existing mortgages are taking advantage of the nearly 200 basis points drop in rates since their October 2023 peak, locking in lower payments through refinancing.

This surge in refinancing may serve as an indicator of what's to come for the housing market. As more homeowners secure favorable refinancing terms, it could pave the way for a recovery in existing home sales later this year. However, it’s important to remember that we’re still in the slow season for real estate, so any spikes in activity might take a little longer to materialize.

Buyers Are Becoming More Optimistic

Consumer sentiment about the housing market remains cautious but is showing signs of improvement. According to Fannie Mae’s Home Purchase Sentiment Index, the index rose slightly to 72.1 in August. However, 83% of respondents still believe it’s a “Bad Time to Buy.” This pessimism has persisted for some time now, but there’s an increasing sense that lower mortgage rates and potentially lower home prices could be on the horizon.

As someone who has weathered multiple market cycles, I always remind my clients to look beyond current sentiment. Even during times when consumer confidence was low—like the early pandemic—those who bought homes benefited from long-term price appreciation and historically low mortgage rates. The market may not look perfect right now, but opportunities exist if you're ready to move when the conditions are right.

The Best Time to Buy is Coming Soon: September 29 - October 5

Mark your calendars! According to Realtor.com, the best week to buy a home is approaching—September 29 to October 5. Historically, this is when buyers experience the best combination of increased inventory and reduced competition. As sellers become more motivated to close deals before the year ends, buyers can find more bargaining power, leading to better negotiations and pricing opportunities.

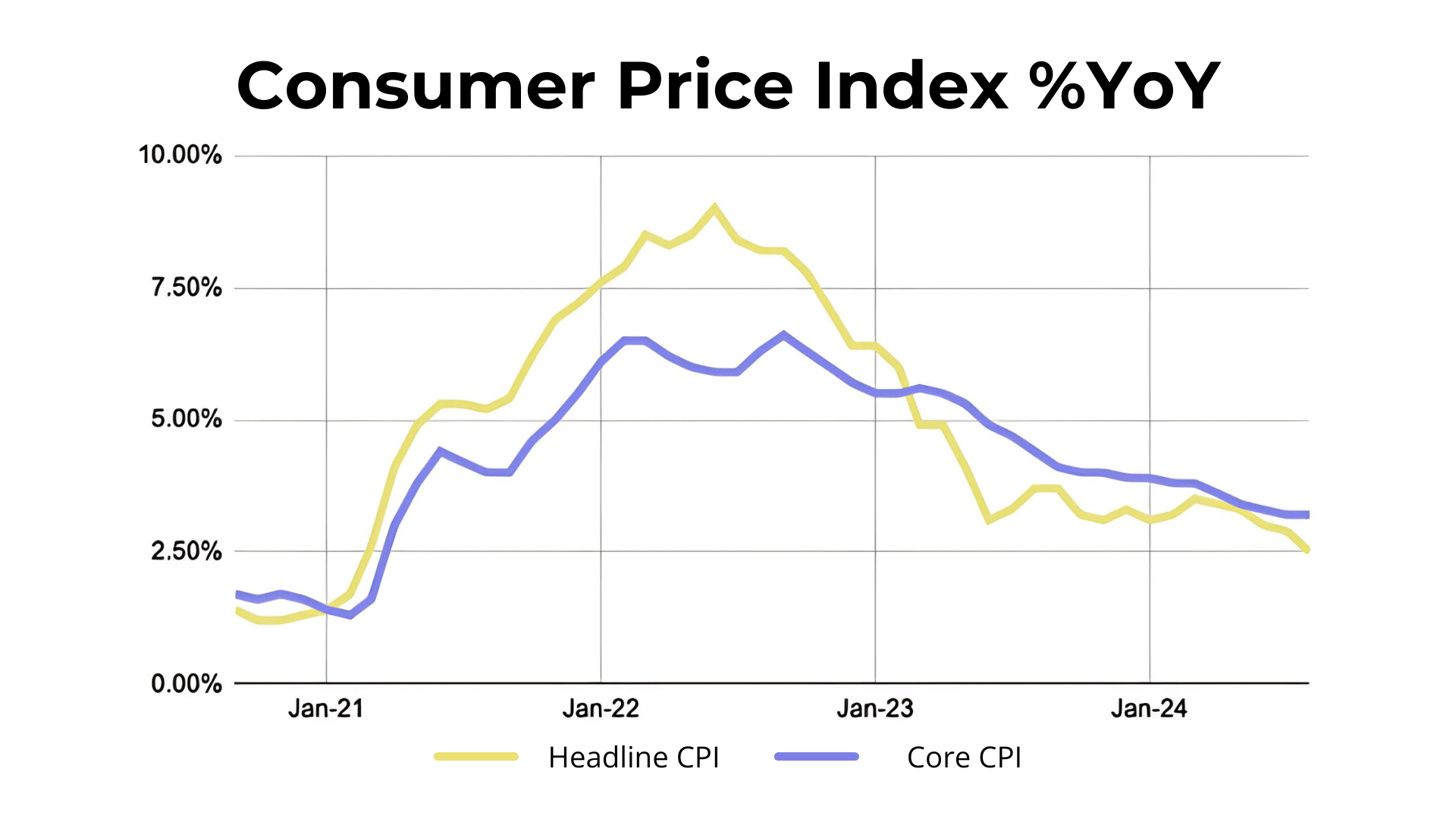

Inflation Trends and Federal Reserve Outlook

Inflation remains a critical factor in the Federal Reserve’s decision-making process. In August, headline inflation dropped from 2.9% YoY to 2.5% YoY, primarily driven by falling energy prices. On the other hand, core inflation, which strips out energy and food prices, stayed flat at 3.2% YoY, driven by rising housing costs.

While consumers tend to focus on headline inflation (especially lower gas and food prices), the Fed is more concerned with core inflation. Given that core inflation remains stable, the likelihood of a large 50 basis point rate cut in the upcoming September 18 meeting seems low. However, we could still see incremental cuts, which would continue to push mortgage rates down even further—good news for potential buyers and sellers alike.

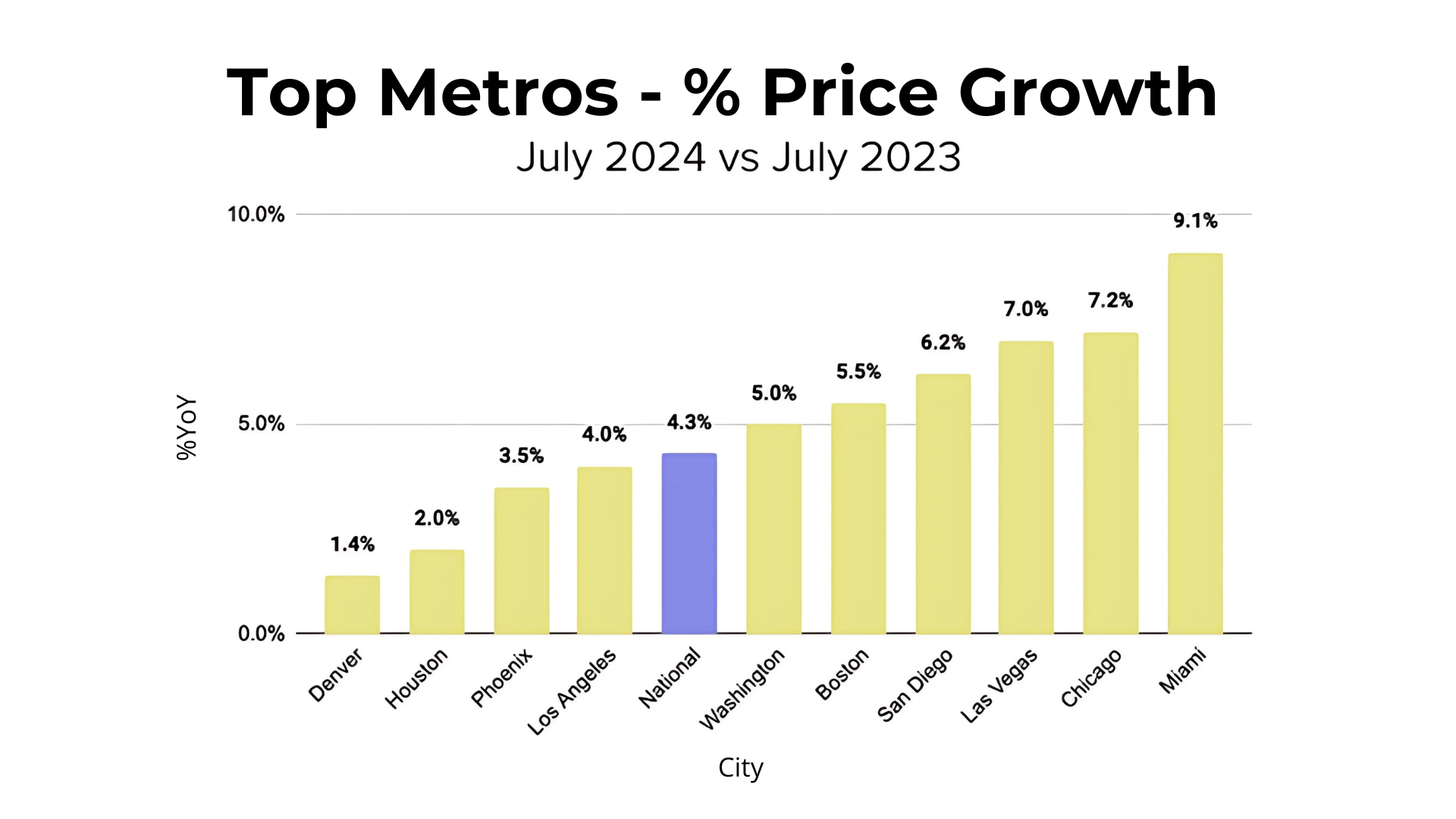

Home Prices: Growth is Slowing Down

According to CoreLogic, national home prices were flat month-over-month in July 2024, but they’re still up 4.3% year-over-year. Affordability issues and the typical seasonal slowdown have kept a lid on price growth in recent months. While prices are still increasing in many markets, the rate of growth has cooled, which may provide some relief to buyers who have been sidelined due to rising costs.

Market Hotspots: The Hottest Housing Markets in August

For what feels like the millionth month in a row, Manchester-Nashua, NH remains the hottest housing market in the U.S., driven by strong demand and fast-paced home sales. Interestingly, the Northeast and Midwest continue to dominate the top 20 hottest housing markets, with these regions consistently outperforming others in terms of listing views and quick home sales.

Final Thoughts: The Road Ahead

The national real estate market is in a state of flux. Mortgage rates are falling, but demand recovery has yet to fully materialize. Refinancing is surging, and buyers are cautiously optimistic about the future.

The next few months will be crucial as we see how the Fed’s decisions, inflation trends, and economic data shape the housing market.

Whether you're a buyer, seller, or investor, it’s essential to stay informed and ready to act when the right opportunity presents itself. At Digital Realty US, I’m here to help you navigate these ever-changing conditions and make smart, strategic decisions.

Categories

Recent Posts

GET MORE INFORMATION