Navigating Real Estate Trends Amid Economic Shifts: A Boston Digital Realty Broker's Perspective

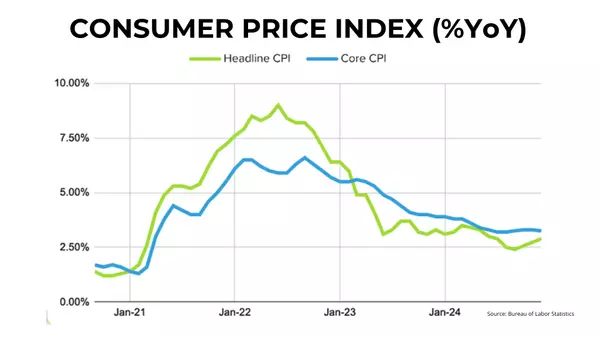

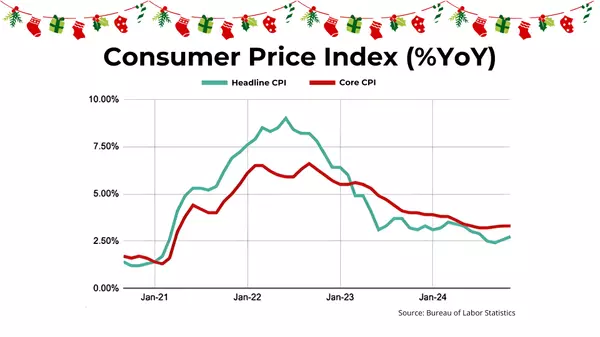

Inflation Insights

In October, the Consumer Price Index (CPI), a key indicator for inflation, maintained its stability month-over-month. This equilibrium, balancing falling energy prices against rising shelter and food costs, resulted in a "headline" CPI drop to +3.2% on a year-over-year basis, with the "core" CPI easing to +4.0%. These insights, courtesy of the Bureau of Labor Statistics, lay the groundwork for an intriguing economic narrative.

The bond market celebrated, responding to lower-than-expected CPI figures with a substantial rally. The 10-year US Treasury yield plummeted below 4.5%, and the average rate on a 30-year mortgage decreased to 7.36%, down from 8.03% just a month ago, as reported by Mortgage News Daily. This unexpected development sparked speculation about the Federal Reserve's future policy directions.

Shifts from Hikes to Cuts

Remarkably, the market's outlook underwent a significant shift after the release of the CPI figures. Initially factoring in a 30% chance of a rate hike in January, the market is now considering the possibility of rate cuts. Looking forward, there are indicators suggesting that the market is pricing in four rate cuts before the end of 2024, challenging the Fed's "higher for longer" stance.

A day after the CPI revelation, the Bureau of Labor Statistics released the Producer Price Index (PPI), revealing a 0.5% month-over-month drop in the "headline" PPI. The year-over-year figure stood at just +1.3%, providing further nuance to the evolving economic landscape for businesses.

Resilience in Retail

Despite a 0.1% month-over-month decline in retail sales in October, the result exceeded expectations, particularly considering falling gas prices. It's crucial to note that the retail sales figure doesn't account for inflation. Retail sales excluding autos and gas even showed a 0.1% month-over-month increase, according to the Census Bureau.

Insights into the Housing Market

The MBS Highway Housing Survey for November unveiled a deceleration in buyer activity, particularly in the Northeast, attributed to 30-year mortgage rates briefly exceeding 8% in October. Homebuyer pessimism is apparent in Fannie Mae's Home Purchase Sentiment survey, with a record 85% expressing that it's a "Bad Time to Buy." However, it's essential to compare this against the fact that 65% held a similar sentiment in June 2021, and home prices have risen by 20% since then.

Zillow's October Housing Report

Zillow's report highlights a nuanced scenario, with home prices decreasing month-over-month in most US markets due to high mortgage rates and the seasonal housing cooldown. However, year-over-year, 34 of the 50 largest markets still witness home values on the rise. Significant declines in Austin and New Orleans (-9% YoY) contrast with increases in Hartford, CT (+11% YoY), and Milwaukee, WI (+9% YoY).

Perspective from Builders

The NAHB's Housing Market Index, also known as the Builder's Confidence Index, dropped to 34 in November, indicating a contractionary environment. Higher mortgage rates for potential buyers and increased borrowing costs for builders are contributing factors. However, it's crucial to consider that the index was at 33 last November, and recent rate declines might not be fully reflected in this survey.

As we navigate these economic shifts, it's crucial to stay informed and agile in the real estate market. Keep an eye on evolving trends, policy changes, and consumer sentiments.

In the next installment, we'll continue our exploration of the real estate landscape, bringing you valuable insights from Digital Realty broker's perspective in the heart of Boston. Stay tuned for more!

Categories

Recent Posts

GET MORE INFORMATION