Navigating the Mortgage Market: Insights for July 2024

As we move through July 2024, the mortgage market is showing intriguing developments that can significantly impact home buyers and sellers in the Greater Boston area. Let's delve into the latest trends and what they mean for anyone considering real estate transactions.

Current Mortgage Rates

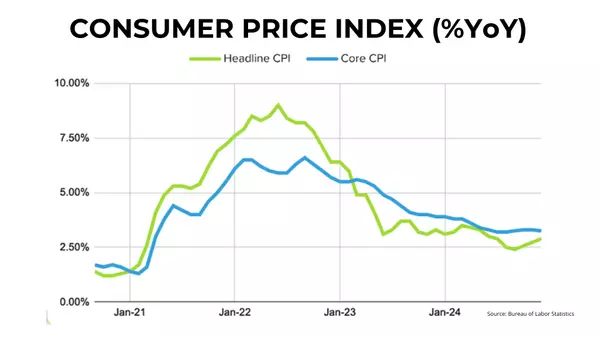

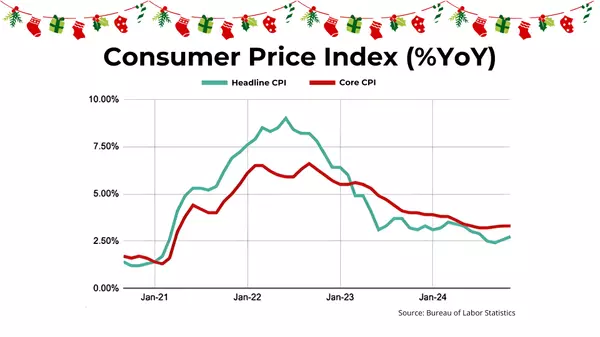

Over the past few weeks, average 30-year mortgage rates have remained stable, fluctuating between 7.00% and 7.15%. This stability follows a period influenced by the May PCE report, which indicated flat headline inflation and a modest 0.1% growth in "core" inflation. These factors have played a role in keeping mortgage rates predictable, albeit amid mixed signals from recent jobs data.

Federal Reserve Rate Cut Odds

Looking ahead, there's growing speculation about potential rate cuts by the Federal Reserve in upcoming Federal Open Market Committee (FOMC) meetings:

- July 31: Odds stand at 9%, down slightly from 10% two weeks ago.

- September 18: A significant increase to 93%, up from 62% previously.

- November 7 and December 18: Both meetings show odds at 97% and 99%, respectively, reflecting strong expectations for rate adjustments.

These anticipated rate cuts could lead to more favorable mortgage rates for prospective home buyers in Greater Boston, presenting an opportune moment to consider entering the market.

Market Stability and Confidence

The stability of mortgage rates within the 7.00-7.15% range provides a level of predictability crucial for both buyers and sellers.

This stability helps maintain confidence in the real estate market, potentially encouraging increased transaction activity.

As economic indicators send mixed messages, understanding these dynamics becomes pivotal for making informed decisions.

Economic Impact and Considerations

Recent jobs data highlights the broader economic landscape. With inflation pressures showing signs of easing and potential rate cuts on the horizon, staying informed is key to navigating the real estate market effectively.

These developments underscore the importance of monitoring economic trends that could influence mortgage rates and overall market dynamics in Greater Boston.

Conclusion

In conclusion, keeping abreast of mortgage rate trends and economic indicators is essential for anyone involved in real estate transactions.

As the potential for Fed rate cuts looms and mortgage rates remain stable, now could be an advantageous time to explore opportunities in the Greater Boston area.

For personalized insights and expert guidance tailored to your real estate needs, reach out to Digital Realty today. Stay informed, stay ahead, and make confident decisions in this evolving market landscape.

Categories

Recent Posts

GET MORE INFORMATION