Navigating the Rising Tide of Long-Term Mortgage Rates

The Numbers Speak

According to data from Freddie Mac, the 30-year fixed mortgage rate has reached 7.79%, a noticeable increase from the 7.63% recorded just a week ago. To put this into perspective, one year ago, this rate stood at 7.08%. These numbers underscore the remarkable transformation that has unfolded in the real estate financing landscape.

Affordability Squeeze

The consequence of higher mortgage rates is felt most acutely by potential homebuyers. As rates climb, so do monthly mortgage payments, making homeownership more elusive for many Americans. In a market that was already a challenge for affordability, these rising rates are pushing the dream of owning a home further out of reach for some.

The Dilemma for Existing Homeowners

For those who secured mortgages at historically low rates two years ago, often below 3%, selling and moving to a new home becomes a complex equation. The current cost of financing a home is substantially higher, leading many to reconsider their plans to sell.

Market Slowdown

The effects of the rising rates are also evident in the sales figures. Sales of previously owned homes have declined for four consecutive months, marking the slowest pace in over a decade. The affordability hurdle is clearly impacting demand.

A Tale of Two MarketsIn contrast, the pace of new-home sales continues to astound economists. These newly constructed homes are attracting buyers with innovative incentives such as interest rate buydowns and more compact floor plans to boost affordability.

Builders in the Spotlight

Homebuilders, in particular, have found themselves in an unexpected advantageous position, benefiting from the Federal Reserve's efforts to curb inflation through interest rate hikes. Their ability to cater to the demand for newly built homes is a testament to their adaptability in the evolving market.

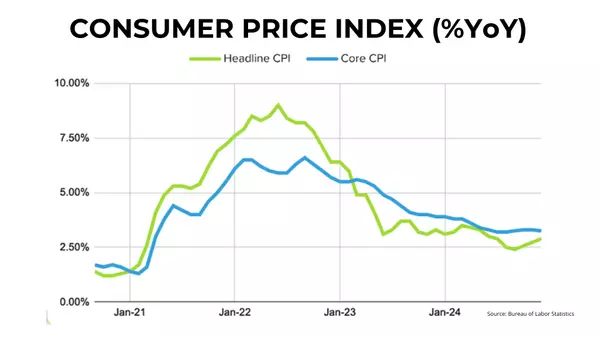

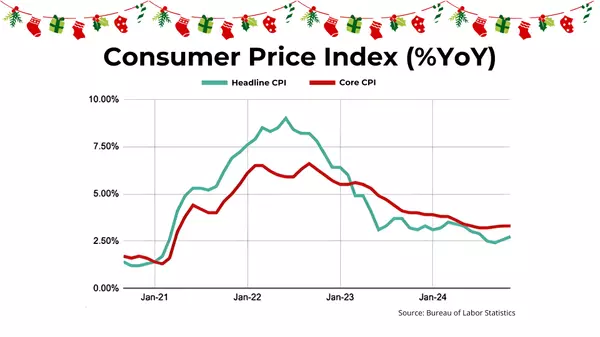

The Rising Tide of Mortgage Rates

Mortgage rates are closely tied to the 10-year Treasury yield, which is a pivotal factor influencing the cost of borrowing for homebuyers. Factors such as expectations for future inflation, global demand for U.S. Treasuries, and Federal Reserve policy decisions play a significant role in shaping these rates.

As we navigate this era of rising mortgage rates, it's crucial to recognize that the real estate market is not a monolithic entity; it's a mosaic of unique opportunities and challenges. While the challenges presented by increasing rates are evident, they also illuminate the necessity for adaptability and strategic thinking.

Buyers and sellers alike are encouraged to think creatively and consider the full spectrum of the market.

While affordability concerns persist, the market isn't static. New-home sales, innovative incentives, and evolving buyer preferences reveal that opportunities still abound.

In this shifting landscape, the most successful participants in the real estate market will be those who embrace change, stay informed, and take advantage of the myriad possibilities that exist within this evolving environment. The rising tide of mortgage rates may be a challenge, but it can also be a catalyst for growth and adaptation in the world of real estate.

Categories

Recent Posts

GET MORE INFORMATION