The Inevitable Snapback: What Low Home Sales Mean for the Future Market

In recent weeks, a striking analysis emerged regarding the current state of existing home sales in relation to population growth.  This comparison sheds light on a significant disparity: despite a growing population, home sales have not kept pace. This disconnect points to a potential "snapback" in the housing market, where a surge in transactions could be on the horizon. Here’s a closer look at the data and what it implies for the real estate industry.

This comparison sheds light on a significant disparity: despite a growing population, home sales have not kept pace. This disconnect points to a potential "snapback" in the housing market, where a surge in transactions could be on the horizon. Here’s a closer look at the data and what it implies for the real estate industry.

This comparison sheds light on a significant disparity: despite a growing population, home sales have not kept pace. This disconnect points to a potential "snapback" in the housing market, where a surge in transactions could be on the horizon. Here’s a closer look at the data and what it implies for the real estate industry.

This comparison sheds light on a significant disparity: despite a growing population, home sales have not kept pace. This disconnect points to a potential "snapback" in the housing market, where a surge in transactions could be on the horizon. Here’s a closer look at the data and what it implies for the real estate industry.Current Home Sales vs. Population Growth

In 2023, the United States saw 4.1 million existing homes sold, a figure that mirrors sales numbers from 2008. This static trend becomes more alarming when considering the context of population growth. Since 2008, the U.S. population has increased by 40 million people. Historically, more people should equate to more home sales, assuming a stable rate of homeownership and market conditions. However, this hasn’t been the case.The Pre-COVID Benchmark

To further illustrate the anomaly, let’s consider the pre-COVID average. Between 2015 and 2019, existing home sales averaged 5.2 million per year. This baseline underscores how far the market has diverged from expected trends. Given the population increase, home sales should arguably be higher than the pre-COVID average, not lower.Factors Behind the Slowdown

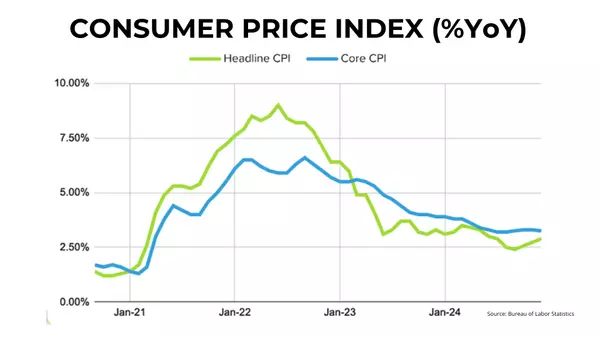

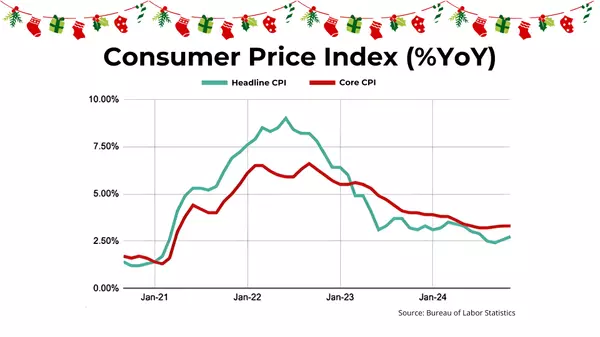

Several factors contribute to this mismatch between population growth and home sales:- Economic Uncertainty: Post-COVID economic recovery has been uneven, with inflation concerns and fluctuating job markets making consumers more cautious about large investments like home purchases.

- Mortgage Rates: The rise and fall of mortgage rates significantly impact homebuyer affordability. Recent dips below 7% are encouraging, but higher rates over the past year have deterred many potential buyers.

- Housing Supply: Limited inventory has been a persistent issue. Even as demand exists, the shortage of available homes keeps sales numbers low.

- Consumer Sentiment: As noted, consumer confidence has dipped, driven by inflation worries and fears of rising unemployment. This sentiment directly affects the willingness of people to buy homes.

The Potential for a Market Snapback

Given these conditions, a snapback—or a sudden increase in home sales—seems inevitable. Here’s why:- Pent-Up Demand: Many potential buyers have been sidelined due to economic uncertainty and high mortgage rates. As conditions stabilize, these buyers are likely to re-enter the market.

- Demographic Pressures: The growing population includes many reaching prime home-buying age. This demographic shift will inevitably boost demand for housing.

- Economic Adjustments: If inflation continues to cool and employment remains stable, consumer confidence is likely to rebound, further encouraging home purchases.

Preparing for the Future

Real estate professionals should be ready for this anticipated increase in activity. Here are some strategies:- Engage Potential Buyers: Keep in touch with clients who have been hesitant to buy, updating them on favorable changes in the market.

- Monitor Mortgage Rates: Stay informed about mortgage rate trends and educate clients on how these affect affordability.

- Address Inventory Challenges: Work closely with sellers to ensure homes are market-ready and priced competitively to meet expected demand.

- Leverage Technology: Utilize virtual tours, online marketing, and digital transaction tools to streamline the buying process and reach a broader audience.

Categories

Recent Posts

Advancing Multi-Family Housing: Legislative Updates and Market Insights

2024 in Review: NH Housing Market's Affordability Crisis

Mortgage Rates Stay High Amid Fed’s Conservative Rate Outlook

December CPI Eases Inflation, Boosting Hopes for Boston’s Spring Housing Market

The Future of Massachusetts Transit in Governor Healey’s Vision

Mayor Wu's 2025 Plan to Address Rising Tax Bills

Mortgage Rates Drop Below 6.7%—What’s Next for Buyers?

Where Are Home Prices Headed? Experts Predict Growth Through 2029

Will Lower Mortgage Rates Unlock the Housing Market in 2025?

Boston Real Estate Market Update at a glance, December 2024 Trends

GET MORE INFORMATION