The Mortgage Market: Rising Rates and Evolving Trends

Mortgage rates and bond yields have surged through October and early November, presenting new challenges for prospective buyers and signaling shifts in the housing market’s recovery path.

Mortgage rates and bond yields have surged through October and early November, presenting new challenges for prospective buyers and signaling shifts in the housing market’s recovery path.

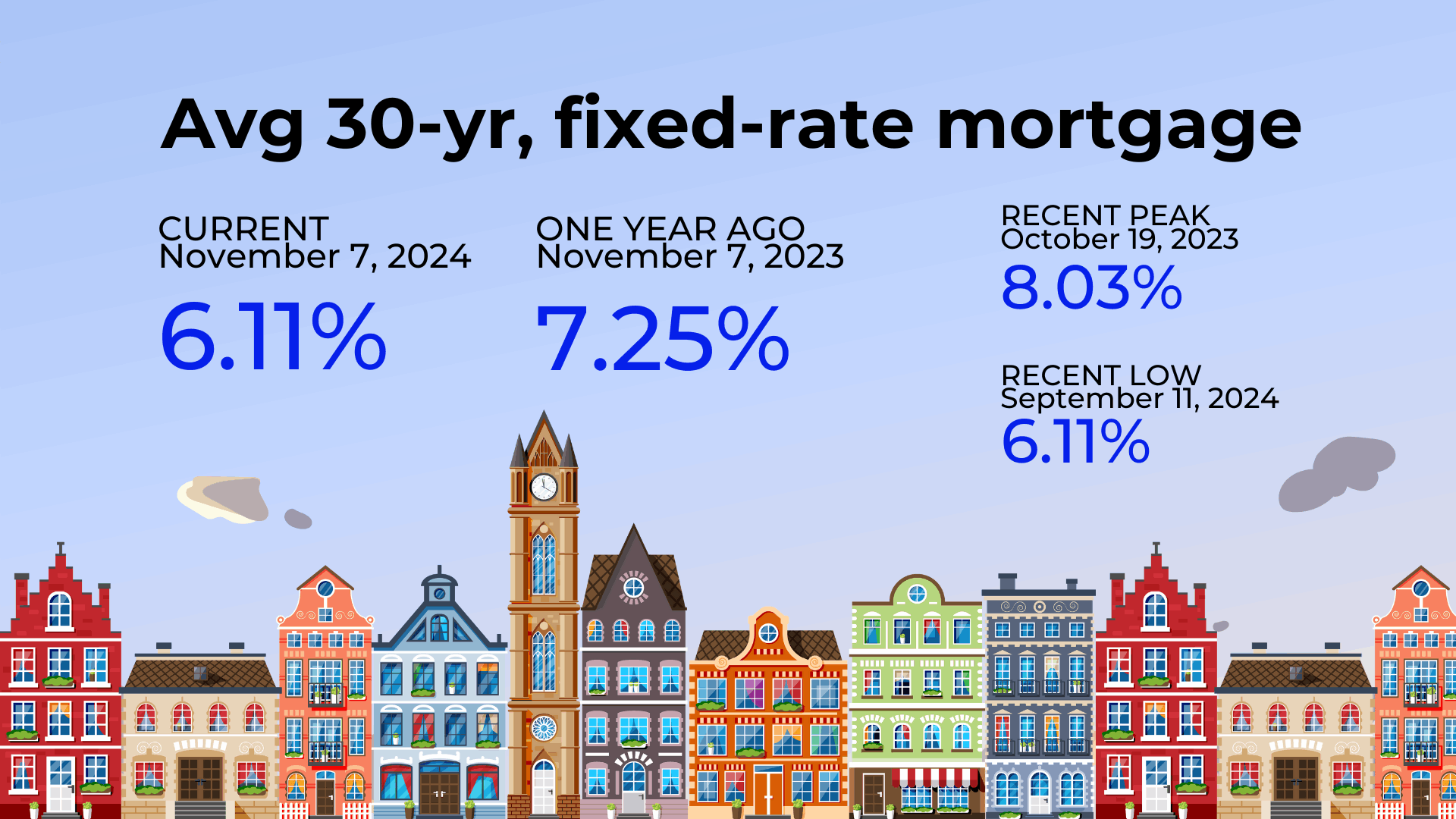

The Federal Reserve's recent rate cuts haven’t curbed rising mortgage rates—in fact, rates have jumped nearly a full percentage point since the Fed’s first cut on September 18, quashing early signs of recovery in existing home sales.

What the Fed Futures Market Tells Us

Looking ahead, the Fed futures market offers insights into potential rate cuts:

- December 18, 2024: The market is pricing a 66% probability of another 25 basis points (bps) cut, bringing the Fed Funds Rate range to 4.25–4.50%.

- January 29, 2025: There's a 51% chance that rates will remain steady. However, a further 25 bps cut could drop the rate range to 4.00–4.25%.

With rate cuts on the horizon, mortgage rates may begin to stabilize, but the market’s uncertainty is evident, as future rate cuts remain far from guaranteed.

Expert Insights on the Market Outlook

Lawrence Yun, NAR’s Chief Economist: Yun forecasts a gradual rise in existing home sales, moving from 4.47 million in 2025 to over 5 million in 2026. Price appreciation, however, is expected to slow, aligning more closely with the consumer price index as new housing supply enters the market.

Brian D. Luke, Head of Commodities, Real & Digital Assets: Luke highlights that home price appreciation has been cooling, showing its slowest annual growth since mortgage rates peaked in 2023. Even as prices decelerate, the market reached new all-time highs for the 15th consecutive month, adjusted for seasonality, but the long-term trend suggests more modest growth.

Key Takeaways for Buyers and Sellers

- Higher Mortgage Costs: Rising mortgage rates mean higher borrowing costs, impacting affordability for buyers.

- Slower Price Appreciation: With decelerating price growth, buyers may find fewer bidding wars, while sellers will need to price competitively.

- Inventory Expansion: Increasing supply could offer more options for buyers, helping to balance the market.

As rates continue to shift, a watchful eye on Fed decisions and mortgage trends will be crucial for those navigating the housing market. Whether planning to buy or sell, staying informed and adaptable will be key in the evolving landscape.

Categories

Recent Posts

GET MORE INFORMATION