The Case-Shiller Chronicles

Once again, the Case-Shiller national home price index has seized the real estate spotlight, hitting a historic peak in July 2023. This revelation is more than just a headline; it signifies the remarkable resurgence of the housing market. Remember that modest 3% price dip that caught our attention in the latter half of 2022? Well, it's safe to say that it's been swiftly erased, and then some. But let's dive deeper into the data and uncover the intriguing insights it holds!

A Streak of Ascension

The national price index has been on an unrelenting climb, with six consecutive months of month-over-month gains. This consistent upward trajectory paints a vivid picture of market resilience and demand.

Cities Ascending to New Heights

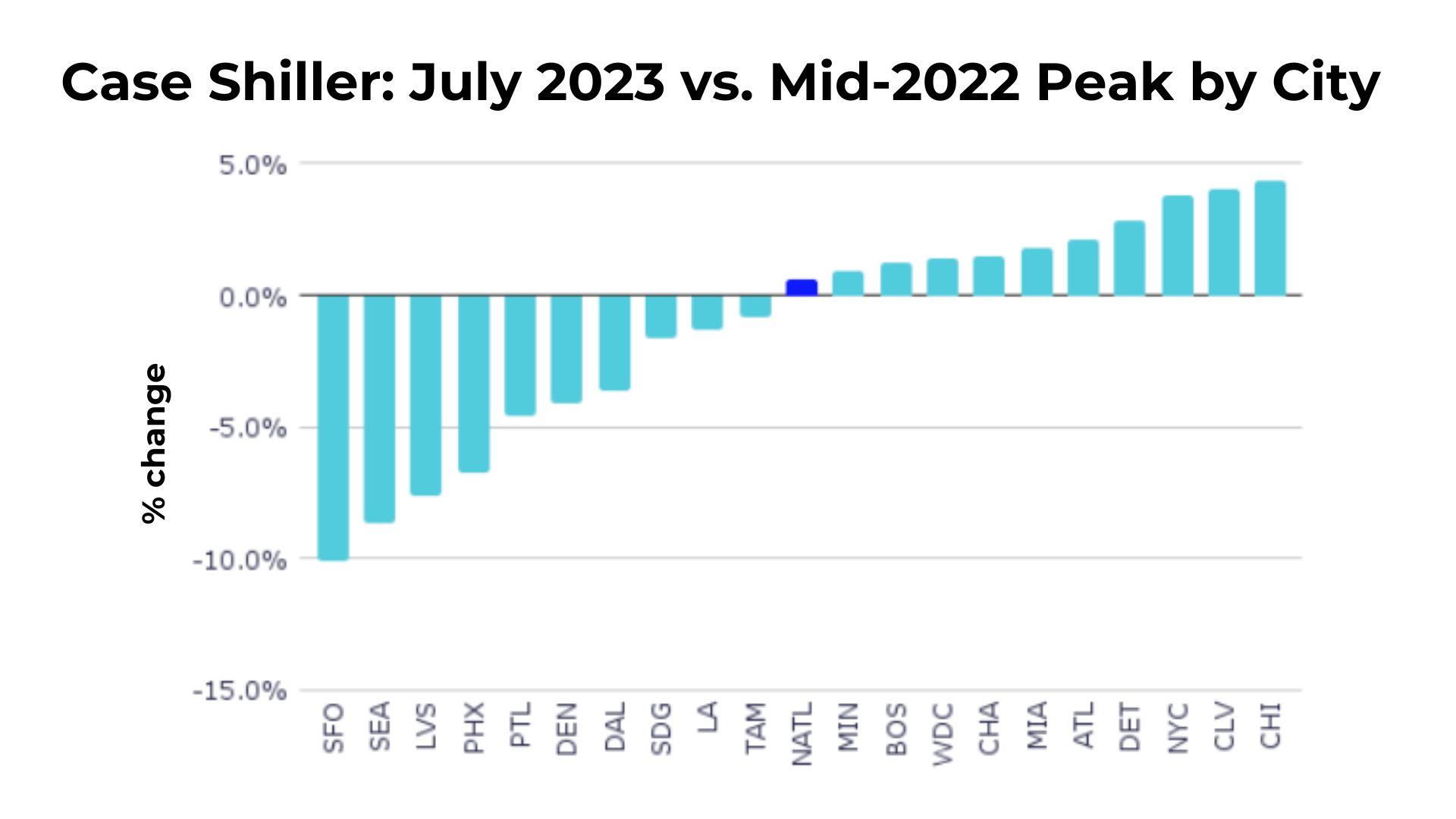

Delving into the individual city indices reveals even more fascinating developments. A remarkable ten major cities have achieved all-time highs in their price indices. Among them, Chicago and Cleveland stand out, proudly perched 4% above their mid-2022 peaks. Meanwhile, the likes of Tampa Bay, Los Angeles, and Dallas are poised on the brink, mere months away from etching their own record-breaking moments.

Resilience Amidst Challenges

Not all cities have followed the same narrative, however. San Francisco, Seattle, Las Vegas, and Phoenix found themselves in the shadows of their mid-2022 peaks, with declines ranging from 7% to 10%. Nevertheless, there's a silver lining. Both Seattle and Phoenix are bouncing back with remarkable speed, hinting at the resilience of these real estate markets.

The national price index has soared an impressive 43% since December 2019, a testament to the market's vigor even in the face of pandemic-induced uncertainties. Miami and Tampa Bay steal the show with astonishing gains of 67%, while Atlanta, Charlotte, Phoenix, and San Diego aren't far behind, each boasting growth exceeding 50%.

The Case for Case-Shiller

Why do we continue to keep a vigilant eye on the Case-Shiller index? The answer lies in its unrivaled accuracy when it comes to gauging home price appreciation. By meticulously tracking vast numbers of transaction pairs—think of House A, which sold for $300,000 in October 2017 and then commanded $550,000 in January 2024—the Case-Shiller index provides the closest approximation to true appreciation. Unlike other home price measures, which can be skewed by factors like property mix (high-end versus low-end), Case-Shiller remains steadfast in its quest to provide the most reliable insight into the dynamic world of real estate.

In a market characterized by twists and turns, the Case-Shiller index serves as our North Star, guiding us through the complex terrain of real estate.

It's more than just data; it's the key that unlocks the secrets of home price dynamics, helping both buyers and sellers make informed decisions in a rapidly evolving landscape.

Categories

Recent Posts

GET MORE INFORMATION