VIDEOS

Check out our video resources to learn more about the buying and selling process

Navigating the Surge: Understanding the Record-Breaking Home Prices in Greater Boston

In this blog post, we'll delve into the key insights from the report, exploring the challenges and opportunities in the current housing market. Breaking Down the Numbers Single-Family Homes The single-family home market experienced a modest 0.2% increase in sales, reflecting a relatively flat trend compared to January 2023. Limited inventory, economic uncertainties, and higher interest rates continue to impact the market. Prospective homebuyers with realistic budgets may find relief elusive, as the supply-demand imbalance persists. Condominiums Condos, on the other hand, emerged as a hot commodity with a 5.5% rise in median sales prices, setting a record at $507,000 for January. However, condo sales witnessed a significant dip of approximately 17%, signaling a supply shortage unable to meet the high demand. Greater Boston Trends Zooming into Greater Boston, the trends become more pronounced. Condo prices in this region skyrocketed, with a 13.4% increase to a median of $625,000. Single-family homes also saw a notable 10.4% price hike, reaching $690,000. However, the number of condo sales decreased by 20.5%, and single-family home sales increased by a modest 3.2%. Town-Specific Insights In Randolph, single-family home sales fell by 25%, contrasting with a 4% price climb to $520,000. Needham experienced a 33.3% drop in single-family home sales, accompanied by a 20.6% decline in the median sales price to $1,545,000. In Everett, labeled a "housing boomtown," condo sales surged by 400%, and prices soared by 67.5% to $335,000. County Analysis Nantucket and Suffolk counties led in single-family home sales, with increases of approximately 83% and 20%, respectively. Condo purchases showed growth only in Duke (200%) and Hampshire (7.1%) counties. Industry Outlook The Greater Boston Association of Realtors offers a more optimistic outlook, citing a 6.6% increase in single-family listings and a 12.4% rise in condos hitting the market compared to January 2023. These indicators may signal a potential alleviation of supply constraints in the coming months. As the real estate landscape in Greater Boston continues to evolve, both challenges and opportunities arise for homebuyers and sellers. Understanding the market dynamics, keeping an eye on local trends, and staying informed about industry forecasts can empower individuals to make informed decisions in this record-breaking environment.

April 2023 - Greater Boston Real Estate Market Update

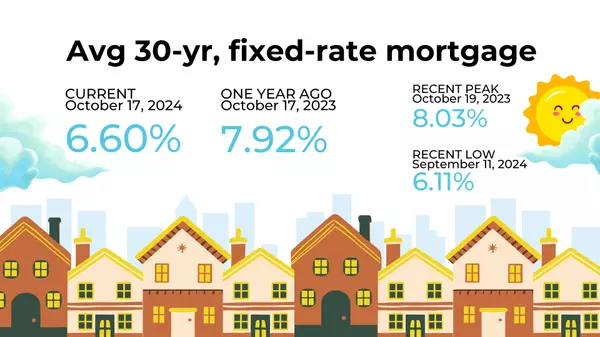

Are you curious about the Greater Boston real estate market in April 2023? In this blog post, we will show you how competitive the market is and what you need to know to succeed in this environment. Single Family Homes In April 2023, the median sales price for single-family homes in the Greater Boston Area remained the same as in March at $825,000. This figure represents a 2.4% decrease compared to April 2022, when the median sales price was $845,000. The market seems to be cooling off and remaining relatively flat year over year. The sale-to-list price ratio for single-family homes in April 2023 was 104%, meaning that on average, homes were selling for 4% above their list price. This ratio reflects a 2.2% increase compared to March 2023 and a 3.0% increase compared to April 2022. Overall, the market remains highly competitive for single-family homes. Condominiums In April 2023, the sale-to-list price ratio for condominiums in the Greater Boston area was slightly less competitive at 100.8%. Condos were selling at just about their list price, reflecting a 0.7% increase compared to March 2023 and a 2.3% decrease compared to April 2022. The condo market is following a similar trend as single-family homes but is slightly less competitive. Inventory For single-family homes in April 2023, there were 1,188 new listings on the market. This figure represents a 9.7% decrease compared to March 2023 and a surprising 31.3% decrease compared to April 2022. The low inventory is driving the market's competitiveness and causing offers to go above the list price. For condominiums, there was a 24.9% decrease in new listings compared to April 2022. Both single-family homes and condominiums are experiencing a significant drop in new listings year over year. Factors and Expectations One reason for the low inventory is that many current homeowners have lower interest rates on their existing homes compared to what they could get if they were to sell and buy a new home. As a result, many homeowners are choosing to stay in their current homes rather than sell and buy a new property with higher interest rates. We expect the market to remain competitive throughout the spring and summer, with homes continuing to sell for above their list price. The volume of new listings over the next few months will influence the extent to which prices rise. We anticipate a continued double-digit decrease in new listings year over year, leading to upward pressure on sales prices for both single-family homes and condominiums in the Greater Boston area. Advice for Buyers If you're considering buying a home, we recommend starting your search a few months ahead of when you plan to purchase. This approach will give you plenty of time to find the right property without feeling rushed to meet specific deadlines. Conclusion Stay tuned for our market update next month, and don't forget to subscribe for more tips and news about the Greater Boston real estate market. If you found this information helpful, please like and share this post!

Boston Rent Control Proposal for 2023

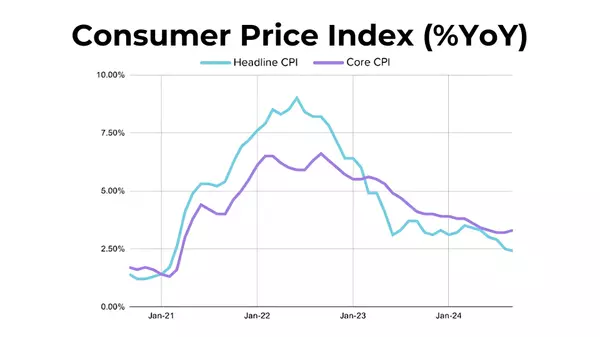

Introduction: Today, we will be discussing the Boston Run Control, including the details of Mayor Wu's proposal that is currently being reviewed by the Boston City Council. Overview: Boston Rent Control, also known as the rent stabilization plan proposed by Mayor Wu, aims to limit annual rent increases to 6% plus any additional changes from the Consumer Price Index, with a cap of 10%. This new law applies to apartments and buildings within the city limits of Boston, with some exceptions. Small landlords with two to six unit buildings, as well as new constructions for the first 15 years of their life, are exempt from this policy to avoid disincentivizing builders and contractors from increasing the supply of apartments in Boston. Previous Rent Control Bills: Currently, rent control is not in place in Boston, and there are no restrictions for landlords or other parties on rent increases. However, the state legislature has considered rent control bills in the past that would allow limitations on rent increases. In 2019, a bill was introduced to the Massachusetts House of Representatives that would have given cities and towns the ability to enact rent control policies, but it did not progress out of the committee. Headwinds: Mayor Wu's proposal still needs approval from the Boston City Council and the state government. It is important to note that the concept of rent control was deemed illegal in 1994 in Massachusetts. Therefore, Mayor Wu faces significant challenges to get her proposal passed. There are concerns that the 6% cap plus inflation may disincentivize landlords from maintaining their buildings and doing repairs, as they would not be able to recoup the value of those repairs by raising rent. There is also opposition to the proposal on both sides of the political spectrum. Conclusion: Mayor Wu's proposal would require approval from the state government, including the governor. While Governor Healy has not yet taken a clear stance on the issue, there is potential for approval at the state level. Rent control was previously in place in Boston, Cambridge, and Brookline, but was later repealed. We invite our readers to leave their comments on whether they believe rent control is necessary in Boston or if other solutions, such as increasing the supply of housing, should be pursued. We will continue to provide updates on this topic in the future.

Categories

Recent Posts