VIDEOS

Check out our video resources to learn more about the buying and selling process

Mortgage Market Update: Steady Rates and Easing Inventory Bring Cautious Optimism

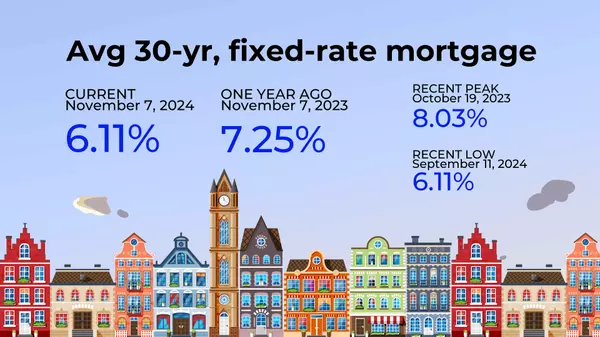

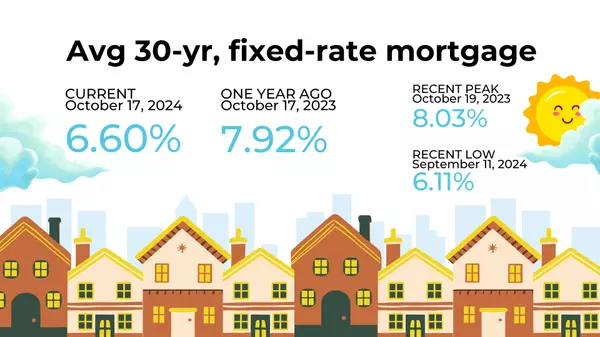

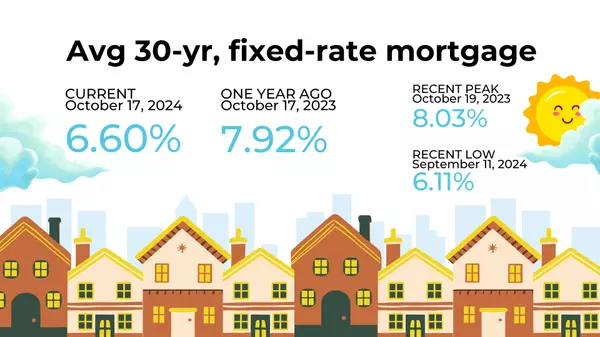

After last week’s uptick, average 30-year mortgage rates have held steady around 6.60%. It’s worth noting just how far we've come—in October 2023, mortgage rates peaked at a staggering 8.03%. Since then, rates have moderated significantly, a welcome change for today’s buyers. Current Fed Policy and Upcoming Rate Cuts Today, the Federal Funds Rate stands in a range of 4.75%–5.00% following a recent 50 basis point cut. The next Federal Open Market Committee (FOMC) meeting on November 7 has a 90% probability of a 25 basis point rate cut and a 10% chance of holding steady. This probability has ticked up recently, underscoring the Fed’s commitment to loosening policy gradually. And looking forward to the December 18 FOMC meeting, markets show a 74% likelihood that rates will be a full 50 basis points below current levels by year-end. If cuts continue, they could drive further stability in mortgage rates—potentially easing the market’s affordability challenges. Easing Supply Constraints and Market Shifts It’s not just rates making headlines; housing inventory is also shifting. After years of constrained supply, inventory levels have begun to recover. In early fall, active listings were up 20% from a year ago—a significant jump but still about one-third below pre-pandemic levels. As job changes, life events, and increased mobility gradually lead more owners to sell, we’re likely to see inventories continue their slow, steady increase. Lawrence Yun, Chief Economist at the National Association of Realtors, put it well: “A market requires both sellers and buyers. The passage of time means more inventory, as life changes drive more listings.” With increased inventory, buyers could face slightly less competition and gain a bit more leverage in negotiations—particularly if these inventory trends continue. Buyer-Favorable Markets Emerging in Southern Metros Across the country, we’re beginning to see a slight shift in market dynamics. According to Zillow Economist Skylar Olsen, active inventory is lifting the pool of available homes, easing competitive pressures in several metro areas. While the nationwide market remains relatively neutral, some Southern metros—like Atlanta—are beginning to shift toward buyer-favorable conditions. In fact, 10 of the 50 largest U.S. metros are now considered buyers’ markets, all located in states like Florida, Georgia, Texas, Tennessee, or Louisiana. Key Takeaways For anyone considering buying or selling in the coming months, these trends are critical to watch. With mortgage rates stabilizing, inventory levels rising, and regional markets tipping toward buyers, we’re seeing the housing market gradually inch toward balance. While it may take time for these shifts to fully materialize, the outlook is growing increasingly favorable for those waiting on the sidelines. As always, if you have any questions about the market or want help navigating these changes, don’t hesitate to reach out. Here at Digital Realty US, we’re here to guide you through each step with expert insights and local market knowledge.

Builders Show Growing Confidence as Lower Mortgage Rates Drive Optimism

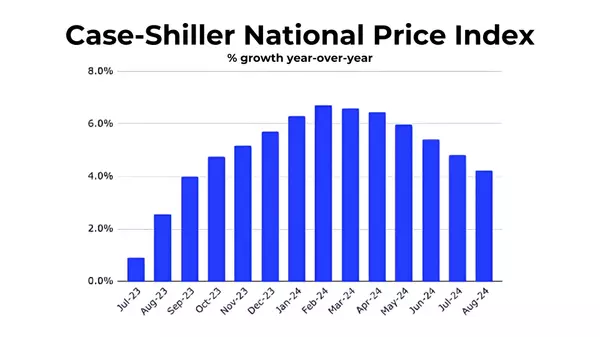

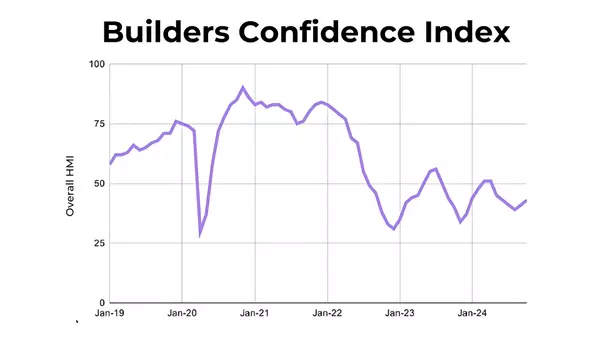

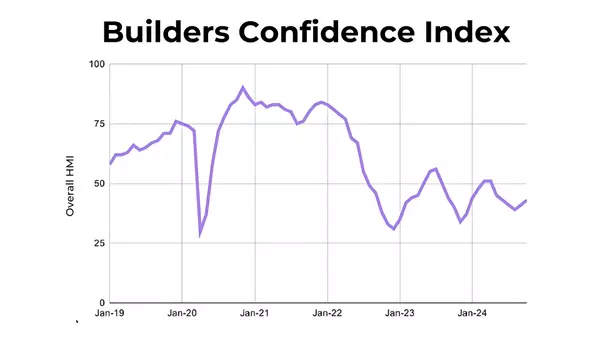

The National Association of Homebuilders (NAHB) Confidence Index saw an encouraging rise of 2 points in September, bringing it to 43. Now, while this number is still below the bullish threshold of 50 (which signals an expansionary environment for new home sales), it’s the second month in a row of improvement. The momentum we’re seeing is largely due to lower mortgage rates over the past four months, which has given builders renewed confidence in the market. Breaking Down Builder Sentiment The NAHB index is composed of three key elements: Current Sales Expectations, Future Sales Expectations, and Buyer Traffic. In September, all three of these components rose month-over-month. What’s particularly notable is that the Future Sales Expectations component now sits at 57—a bullish signal indicating optimism about the road ahead. The 10-point gap between future and current sales expectations is the largest it’s been in five years, which points to growing builder confidence that lower rates will drive new home sales in the coming months. Homebuyers Waiting for Election Results Even with builder optimism rising, some prospective buyers are still in wait-and-see mode. According to a recent Redfin survey, 23% of first-time buyers said they plan to hold off on purchasing until after the U.S. presidential election. They’re waiting to see what the political landscape will look like and how potential housing policies might affect them. Interestingly, nearly one-third of respondents said that housing affordability is a top-three issue when deciding who to vote for. This underscores just how important housing policy will be in the upcoming election. But as far as solutions go, here’s my take: Rent controls and big first-time buyer grants aren’t the answer. The key to addressing the housing shortage is building more homes. Additionally, keeping large investors out of the single-family housing market would help preserve affordability for individual buyers. Rents Continue to Decline Another trend that’s catching my eye is the continued cooling in the rental market. In September, nationwide asking rents were down 0.5% year-over-year, marking the 14th consecutive month of slight annual declines. Cities like Nashville (-4.8%), Dallas-Fort Worth (-4.0%), Denver (-4.0%), and Austin (-3.7%) saw some of the biggest rent drops, while cities like Cincinnati (+3.4%), DC Metro (+2.9%), and NYC Metro (+2.8%) experienced modest rent increases. Zillow Forecasts Modest Home Price Growth Ahead Looking ahead, Zillow is predicting modest home price growth on a national level. Their latest forecast calls for home prices to rise 2% in 2024, but just 0.9% over the next 12 months through September 2025. The reason? Rising inventory levels are expected to keep price growth in check. Of course, a national average like this means we can expect price declines in certain cities. Zillow’s map reveals where they anticipate potential price softening, so keep an eye on those local markets if you’re thinking about buying or selling. Conclusion As we head into the final months of 2024, there’s a lot to watch in the housing market. Builder confidence is growing, and while mortgage rates have come down slightly, buyers are still cautious—many waiting to see how economic and political factors shake out. Meanwhile, rents are cooling, and home price growth is expected to remain modest in the coming year. For buyers, sellers, and investors alike, it’s a market in flux. Staying informed on these trends and working with a real estate professional who understands both the national and local dynamics can help you make the right decisions moving forward.

Why Did Mortgage Rates Rise After the Fed Cut Interest Rates?

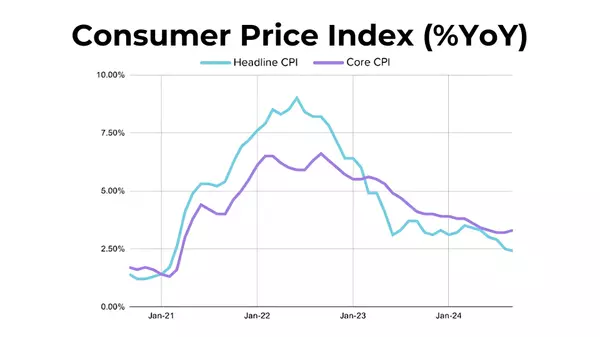

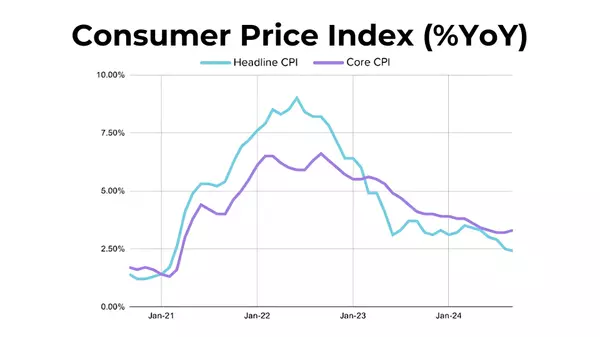

On September 18, the Federal Reserve surprised the market by cutting interest rates by 50 basis points, kicking off a new loosening cycle to ease financial conditions. Typically, when the Fed cuts rates, we expect borrowing costs, including mortgage rates, to decrease. However, in an unexpected turn, average 30-year mortgage rates actually rose by 50 basis points, bringing them to around 6.60%. So, what’s causing mortgage rates to move in the opposite direction? Strong Jobs Growth and Hotter-Than-Expected Inflation The answer lies in the latest economic data, particularly around jobs and inflation. Just days after the Fed’s rate cut, the September jobs report showed stronger-than-expected employment growth, a clear indicator that the economy is still running hot. When the job market is this strong, it can signal rising wages and increased consumer spending, which often puts upward pressure on inflation. Speaking of inflation, the latest Consumer Price Index (CPI) numbers from September weren’t as favorable as markets had hoped. While the headline CPI (which measures overall inflation) eased slightly to +2.4% year-over-year, down from +2.5% in August, the core CPI (which excludes volatile food and energy prices) actually ticked up to +3.3% YoY, from +3.2% in the previous month. Both of these figures came in higher than economists expected, signaling that inflationary pressures are still present. Why Did Mortgage Rates Rise? You might wonder, why would mortgage rates climb when the Fed is cutting rates to stimulate the economy? It’s because mortgage rates are more directly tied to long-term economic expectations rather than the short-term actions of the Fed. When inflation is expected to stick around, even at slightly elevated levels, lenders will price that into their long-term loans, which includes 30-year mortgages. Add to that a strong labor market fueling economic activity, and you’ve got conditions that push mortgage rates higher. In simple terms, while the Fed is doing its part to loosen financial conditions, strong jobs growth and persistent inflation are keeping mortgage rates elevated, at least for now. What’s Next for Mortgage Rates? While this latest economic data isn’t a cause for alarm, it has certainly created uncertainty in the housing market. If inflation and job growth continue to run hotter than expected, mortgage rates could stay higher for longer, despite the Fed’s efforts to cool things down. On the flip side, if we start to see inflation ease and job growth moderate in the coming months, we could finally see mortgage rates respond by heading lower. For now, though, anyone in the market to buy or sell a home needs to keep a close eye on these economic trends. The interplay between inflation, jobs, and Fed policy will continue to shape the housing market as we move further into 2024. Conclusion In the real estate world, it’s never just about one factor. While the Fed’s rate cut signaled an easing stance, the broader economic picture—particularly stronger jobs growth and stubborn inflation—is what’s driving mortgage rates higher. As a result, buyers and sellers should prepare for potential rate volatility as the market continues to adjust to these conditions. If you’re thinking about buying or selling a home in this evolving market, it’s essential to stay informed and work with a knowledgeable real estate professional who can help you navigate these changing dynamics.

Categories

Recent Posts