VIDEOS

Check out our video resources to learn more about the buying and selling process

Common Mistakes First-Time Homebuyers Make in Boston—and How to Avoid Them

As a first-time homebuyer, there are some common pitfalls that can trip you up, but with a little preparation and expert advice, you can avoid these mistakes and buy your home with confidence. At Digital Realty US, we’ve helped countless first-time buyers navigate the Boston market. Here are the most common mistakes we see—and how you can avoid them. Not Getting Pre-Approved for a Mortgage The Mistake: Many first-time buyers start house-hunting before securing a mortgage pre-approval. Without pre-approval, you won’t know how much home you can afford, and when you find your dream home, your offer might not be taken seriously. How to Avoid It: Before you start browsing homes, talk to a lender about getting pre-approved for a mortgage. This not only shows sellers that you’re serious, but it also gives you a clear idea of your budget, so you don’t waste time on homes outside your price range. Pro Tip: Pre-approval can also give you leverage in negotiations, especially in a hot market like Boston’s, where competition is fierce. Underestimating Closing Costs The Mistake: First-time buyers often focus on the down payment and forget about the additional costs that come with closing a deal. Closing costs in the Boston area can range from 2% to 5% of the home’s purchase price and include fees like appraisal costs, loan origination fees, and title insurance. How to Avoid It: Work with your real estate agent and lender to get a clear understanding of all the costs involved. Make sure to set aside a budget for closing costs, so there are no surprises at the closing table. Pro Tip: Some closing costs can be negotiated or rolled into your mortgage. Ask your agent or lender about your options! Falling in Love with the Wrong Property The Mistake: It’s easy to get emotionally attached to a home, especially when it checks most of your boxes. But don’t let your heart rule your head. If a home is out of your budget, needs too many repairs, or is in a less-than-ideal location, it’s probably not the right fit. How to Avoid It: Stick to your priorities and your budget. It’s helpful to make a list of “must-haves” and “nice-to-haves” before you start house hunting. This way, you can stay focused on what’s important and avoid emotional decisions that may lead to buyer’s remorse. Pro Tip: Work closely with your real estate agent to find homes that fit your criteria and meet your long-term goals. A good agent will guide you through the decision-making process with a clear, level-headed approach. Not Working with a Real Estate Agent The Mistake: Some first-time buyers try to navigate the home-buying process on their own to save on commission fees. However, in a competitive market like Boston’s, going it alone can cost you more in the long run. Without an agent, you may miss out on the best properties or overpay for a home. How to Avoid It: Hire an experienced real estate agent who knows the Boston market inside and out. An agent will not only help you find the right home but also negotiate the best deal and guide you through the complex closing process. Pro Tip: At Digital Realty US, we specialize in helping first-time buyers make informed decisions. With our deep knowledge of the Boston market, we’ll make sure you avoid costly mistakes and get the best value for your investment. Conclusion Buying your first home is a major investment, and avoiding these common mistakes can save you time, money, and stress. At Digital Realty US, we’re here to guide you through every step of the process, from pre-approval to closing, so you can buy with confidence.

Mortgage Market Update: Fed Rate Cuts and Jobs Data Push Rates Lower

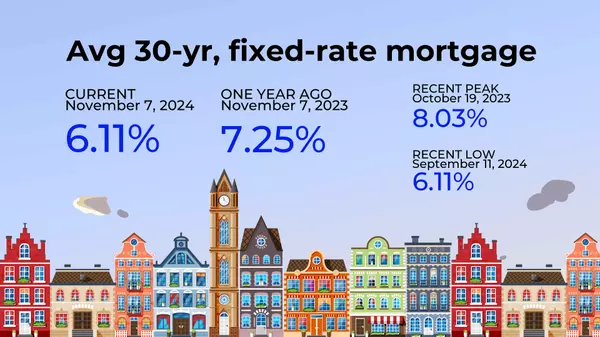

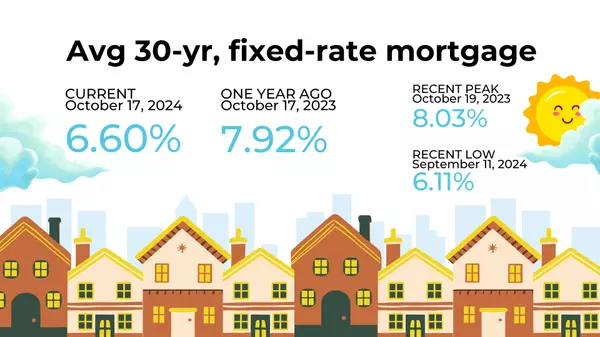

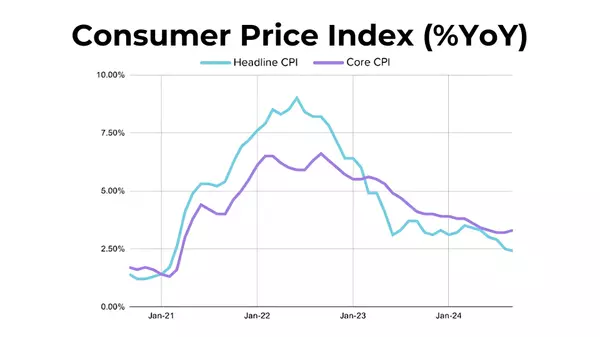

The message from last week’s jobs data was loud and clear: the labor market is cooling off, and this shift is having a direct impact on mortgage rates. Here’s what we saw: JOLTS: Job openings came in much lower than expected. Beige Book: 9 out of 12 regions surveyed reported “flat or declining activity,” up from 5 in the last report. Challenger Report: Announced layoffs spiked, with the weakest hiring plans since 2005. ADP Report: Lowest job gains since January 2021. BLS Report: Only 142,000 jobs added in August, with previous months’ figures revised down by 86,000. How It Affected Mortgage Rates It was the BLS jobs report last Friday that really pushed Treasury yields and mortgage rates down. As of Wednesday, the average 30-year mortgage rate dropped to 6.11%, which is a significant reduction—200 basis points (2.0%) below the October 2023 peak. That’s great news for buyers, but it’s important to note that the CPI report was a bit of a letdown. It took the idea of a 50 basis points rate cut off the table for the time being. Odds on Fed Rate Cuts at Upcoming FOMC Meetings Here’s where things stand with the Federal Reserve’s upcoming meetings and potential rate cuts: September 18: A 100% chance of a rate cut (same as last week), with only a 15% probability of a 50 basis points cut (down from 39% last week). November 7: A 100% chance of a rate cut, and a 46% probability that rates will be 75 basis points lower (down from 49% last week). December 18: Another 100% chance of a rate cut, with a 48% probability that rates will be 100 basis points lower than current levels (about the same as last week). What Does This Mean for You? If you’re considering buying, now could be an ideal time to lock in a mortgage rate before the Fed’s next move. Lower rates mean more purchasing power, which is crucial in high-cost areas like Greater Boston. But with the Fed watching inflation closely, buyers need to stay informed and be ready to act when the opportunity arises. As we head into fall, historically a slower season, I expect some shifts in inventory and competition levels, which could provide a window of opportunity for savvy buyers. Keep in mind that while rates are falling, the overall economic picture is complex, with the potential for more changes as we get closer to the end of the year.

Is CoreLogic Being CoreLogical? A Look at Their Home Price Predictions

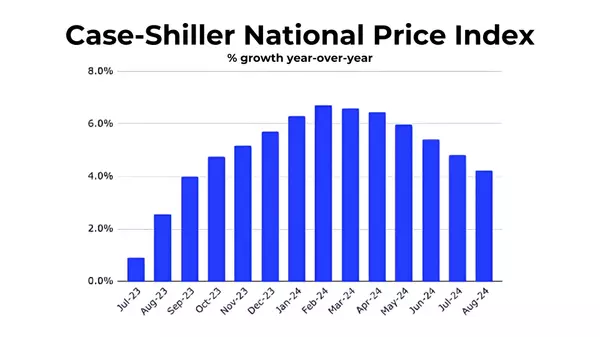

It’s always interesting to look at how CoreLogic predicts home price growth, and I agree—it’s no easy task. In their short-term forecasts, they often show a pattern of underestimating price growth in the first half of the year and overestimating it in the second. This could be due to the seasonal fluctuations in housing markets, or perhaps a response to unexpected economic changes. Their longer-term predictions, though, seem to fare worse. For instance, January 2023 saw them forecasting 3.0% home price growth for the year, but the reality was 6.1%—a significant miss. Predicting 12 months into the future is always difficult, particularly with factors like interest rates, inventory levels, and market sentiment influencing the outcome. Why CoreLogic's Current Forecast May Be Low Looking at CoreLogic’s forecast of just 2.2% home price growth from July 2024 to July 2025, I share your skepticism. Several factors suggest that this prediction might indeed be conservative: Mortgage rates have fallen by 2% over the last four months. Lower rates typically make homes more affordable, encouraging buyer activity, which could drive up prices. Inventory remains low. National inventory is 28% below pre-pandemic levels, which means less supply and more competition for the available homes. Basic economics tells us that lower supply usually results in higher prices. We’ve had two years of sluggish home sales, with annual sales of existing homes stuck around 4 million units. The market may be overdue for a rebound, particularly as rates ease. A Possible Market Turnaround While CoreLogic points to flat price growth during the summer, it’s important to remember that we’re heading into a slower season. Historically, fall and winter months see reduced buyer activity. However, if mortgage rates continue to decline—especially if the Federal Reserve cuts rates further—we might see a boost in demand that drives home prices higher than their forecast. Additionally, economic uncertainties like a potential cooling labor market and the lead-up to the 2024 presidential election could affect buyer behavior. Lower mortgage rates could offset some of these concerns, but buyers may remain cautious until more clarity emerges. Bottom Line While CoreLogic’s Chief Economist Dr. Selma Hepp highlights potential reasons for their conservative forecast, I’d argue that the conditions are ripe for more growth than they expect. With inventory low, mortgage rates dropping, and a market that’s been holding back for some time, a stronger rebound in home prices seems more likely.

Categories

Recent Posts