VIDEOS

Check out our video resources to learn more about the buying and selling process

Mortgage Market Update: Navigating Volatility in Rates and Economic Indicators

Whipsawing Mortgage Rates Over the past few weeks, mortgage rates have been on a rollercoaster ride, influenced by fluctuating economic indicators and central bank actions. Here's a breakdown of the key factors driving this volatility: Jobs Data Impact Positive JOLTS and ADP Reports: Early reports from the Job Openings and Labor Turnover Survey (JOLTS) and ADP Employment Report showed stronger-than-expected job openings and private sector employment gains, initially pushing mortgage rates higher. Mixed Signals from BLS: Contrarily, the Bureau of Labor Statistics (BLS) provided mixed signals with its jobs report, which showed higher-than-expected job additions but also a slight uptick in the unemployment rate. This uncertainty caused mortgage rates to dip temporarily. Inflation and Federal Reserve Actions Lower-than-Expected CPI: Last Wednesday, the Consumer Price Index (CPI) data came in lower than expected, signaling a slowdown in inflation. This positive news, coupled with Federal Reserve Chair Jerome Powell's dovish remarks, helped bring average 30-year mortgage rates back down near 7.0%. Central Bank Rate Cuts: Both the European Central Bank (ECB) and the Bank of Canada cut their interest rates, reflecting their respective efforts to stimulate economic growth and control inflation. However, progress on US inflation has slowed since early 2023, with the core Personal Consumption Expenditures (PCE) price index at 2.8% in April 2024, still above the Fed’s 2% target. Fed Rate Cut Odds The Federal Open Market Committee (FOMC) has been closely watched, especially with the upcoming US Presidential election on November 5. The current odds for rate cuts at upcoming FOMC meetings are as follows: July 31: 9% (steady from 9% on June 10) September 18: 63% (up from 47% on June 10) November 7: 77% (up from 62% on June 10) These odds reflect increasing market anticipation for rate cuts later in the year as economic conditions and inflation dynamics evolve. What This Means for Homebuyers and Real Estate Professionals The volatility in mortgage rates poses both challenges and opportunities for homebuyers and real estate professionals: For Homebuyers Lock in Rates: Given the fluctuations, homebuyers should consider locking in mortgage rates when they dip. Consulting with a mortgage advisor can help determine the best timing. Assumable Mortgages: With rates fluctuating, exploring assumable mortgages, particularly those backed by government loans like FHA and VA, can offer potential savings. However, these come with conditions and complexities that need careful consideration. For Real Estate Professionals Stay Informed: Keeping abreast of economic indicators and central bank actions is crucial for advising clients effectively. Understanding the implications of rate changes can help guide buyers and sellers in making informed decisions. Market Dynamics: Regional variations in home price growth highlight the importance of local market knowledge. While national trends provide a broad picture, local conditions will often dictate specific strategies for pricing, marketing, and negotiations. Conclusion Navigating the current mortgage market requires staying informed about economic trends, central bank actions, and their impacts on mortgage rates. Both homebuyers and real estate professionals need to be agile and well-informed to make the most of the opportunities and mitigate the challenges posed by this volatile environment.

Real Estate News in Brief: Catching Up on Two Weeks of Market Movements

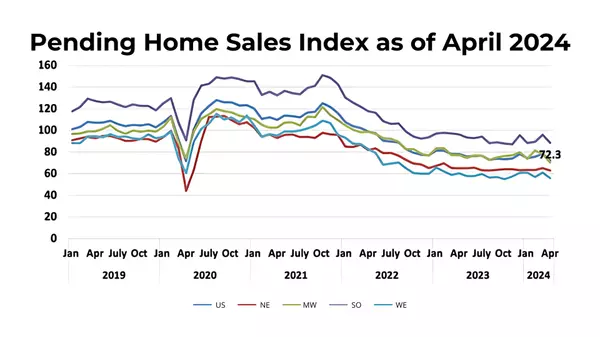

In April, the average 30-year mortgage rates saw a significant increase, rising more than 50 basis points and briefly exceeding 7.5% . This surge has had a noticeable impact on the housing market: Pending Sales Index Drop: The National Association of Realtors (NAR) reported a 7.7% month-over-month and 7.4% year-over-year decline in its Pending Sales Index for April 2024, which fell to 72.3 . This drop to the lowest level in several years suggests that May 2024 existing home sales could fall below 4 million units (seasonally adjusted annual rate). National Housing Index: MBS Highway’s National Housing Index showed a decline for the second consecutive month in June, with the Buyer Activity sub-index dropping 6 points to 45. A reading below 50 indicates a contraction in transaction volume. The Northeast showed resilience, while the Southeast was the weakest region. Home Price Growth Stayed Strong, but Not Everywhere Despite the pressure on transaction volumes, home prices continued to rise, though regional variations were significant: Case-Shiller Index: The Case-Shiller national home price index rose 0.3% month-over-month in March, and 6.5% year-over-year. However, five major city indexes (Dallas, Denver, Phoenix, Seattle, and Tampa) saw month-over-month declines . CoreLogic’s HPI: CoreLogic’s Home Price Index (HPI) reported a 1.1% month-over-month increase in April, following similar growth in March. Year-over-year, home prices were up 5.3% . Job Growth Slowing, but Mixed Signals from BLS Report The employment landscape has shown signs of slowing, despite mixed signals from different reports: JOLTS Report: The April JOLTS report indicated a 5% month-over-month decline in job openings, bringing the total to 8.1 million. This is 18% below the figures from April 2023 and 31% below those from April 2022. ADP Report: The ADP employment report showed only 152,000 new private sector jobs added in April, falling short of the expected 175,000 and marking the smallest gain since January. BLS Jobs Report: Contrarily, the Bureau of Labor Statistics (BLS) reported a higher-than-expected addition of 272,000 jobs in April. However, the unemployment rate also edged up to 4.0% . Lower-than-Expected CPI for May May’s Consumer Price Index (CPI) brought some positive news on the inflation front: The headline CPI was flat month-over-month, while the core CPI grew by only 0.2% MoM. These figures were better than expected, leading to a drop in the year-over-year core figure from 3.6% in April to 3.4% in May, and the headline figure from 3.4% to 3.3%. The Rate Cuts Are Coming? Central banks around the world have begun to adjust interest rates: European Central Bank (ECB): The ECB cut rates for the first time in five years, from 4.00% to 3.75%. However, it warned that domestic price pressures remain strong and did not commit to further cuts. Bank of Canada (BoC): The BoC also reduced rates from 5.00% to 4.75%, with Governor Tiff Macklem indicating the possibility of more cuts if inflation continues to moderate. US Federal Reserve: In contrast, the US Federal Reserve held steady, maintaining its short-term policy range at 5.25%-5.50%. The updated "dot plot" now forecasts 1-2 rate cuts before the end of 2024 and 100 basis points of cuts in each of 2025 and 2026. Conclusion The real estate market continues to navigate through high mortgage rates, fluctuating home prices, and mixed economic signals. As a real estate broker, staying informed on these trends is crucial for advising clients and making strategic decisions. The landscape is complex, with regional variations and economic uncertainties playing significant roles. Keep an eye on these developments to better understand the market dynamics and guide your clients effectively.

The State of Inventory: May 2024 Real Estate Update

In May 2024, the real estate market saw a significant shift with the number of nationwide active listings climbing to 788,000, marking a 35% increase year-over-year and the highest figure since July 2020. While this surge is promising, it’s essential to keep a few critical points in perspective: Historical Context: Despite the recent gains, active listings are still down 33% from pre-pandemic levels. Regional Disparities: Most of the inventory growth is concentrated in a few states, particularly Florida and Texas. Regional Inventory Insights As depicted in the map below, more than half of the states had inventory levels in May 2024 that were over 40% below pre-pandemic levels (indicated by shades of blue). Notably, nine states had inventory levels more than 60% below pre-pandemic figures. Connecticut is facing the most severe shortage, with inventory nearly 80% lower than in May 2019. Florida and Texas Lead the Charge Nearly one-third of the active listings in May 2024 came from just two states: Florida and Texas. Specifically: Florida: Contributed 18% of nationwide active listings, with its inventory now only 4% below pre-pandemic levels. Texas: Contributed 13% of nationwide active listings, with inventory now 2% above where it was in May 2019. It is in these 'green states' that we are seeing the greatest pricing pressures in certain cities due to the relative abundance of listings. The Reality of Assumable Mortgages A common query in today’s market surrounds the concept of assumable mortgages. The idea is enticing: a buyer could 'take over' the seller’s existing loan and benefit from a much lower mortgage rate than what they could secure themselves currently. However, this concept comes with several caveats: Qualifying for the Loan: The new buyer must qualify for the existing loan based on their creditworthiness. Home Value Increase: If the home’s value has increased since the original purchase, the new buyer must cover the difference through additional equity or another mortgage at a higher rate. Extended Closing Process: The process involves substantial paperwork, potentially extending the closing period, which may deter sellers. Key Facts About Assumable Loans Government Loans: Many government loans, such as FHA and VA loans, are assumable under certain conditions. Percentage of Loans: Since 2019, approximately 8% of home loans originated in the US were VA loans, and around 15% were FHA loans—almost a quarter of all mortgages (Source: Realtor.com). Current Listings: Despite this, only 0.4% of current active listings are advertised as offering an assumable mortgage (Source: Realtor.com). This disparity highlights the challenges and complexities of the mortgage assumption process. While assumable mortgages can offer significant interest savings, especially in areas near military bases where VA loans are more common, they are not as prevalent or straightforward as some might assume. Conclusion It’s crucial to understand that assumable mortgages are not a simple or universally available option. They require careful consideration, qualification, and often substantial additional payments. For those who can navigate the complexities, the potential savings are substantial.

Categories

Recent Posts